There is concern that dairy exports may be significantly impacted by the new tariffs. This post will follow the data on the major exports; nonfat dry milk (NDM) and skim milk powder (SMP), cheese, dry whey, and butter. The data and charts shown will use 12-month moving averages and month by month values from the start of 2023 through March 2025, the most recent data available from the USDA. The charts below are in the order of the total amounts of each category mentioned above.

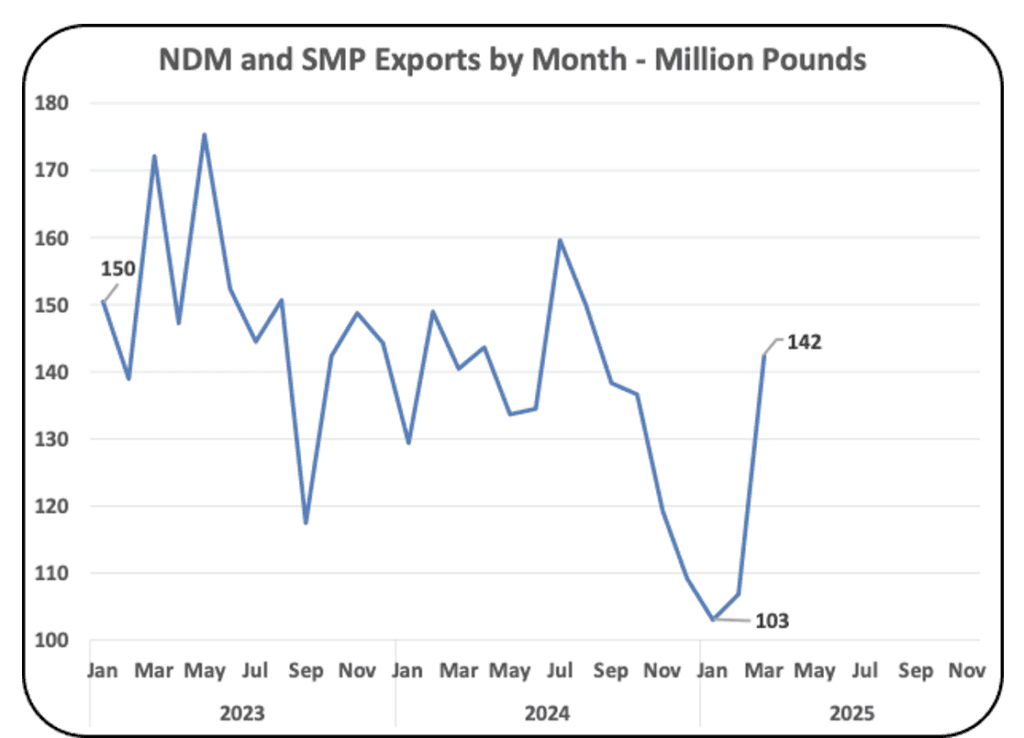

NDM/SMP EXPORTS

NDM/SMP are the largest export items in terms of volume. Chart I follows the 12-month moving averages of net exports. Imports of NDM/SMP are very minimal. There is a continuous decrease in exports since the beginning of 2023. Mexico is the largest importer of NDM.

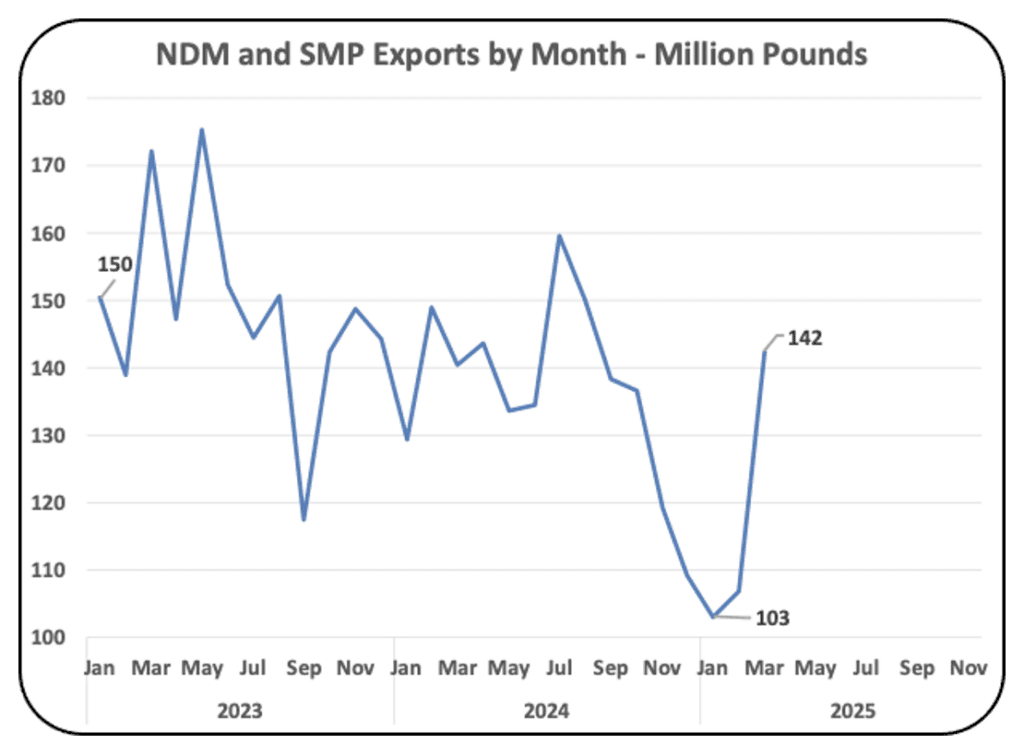

Chart II follows the monthly movements of NDM/SMP exports. They show a significant increase in exports in 2025.

The conclusion for exports of NDM/SMP is that they are not showing any decrease in exports from the tariff negotiations.

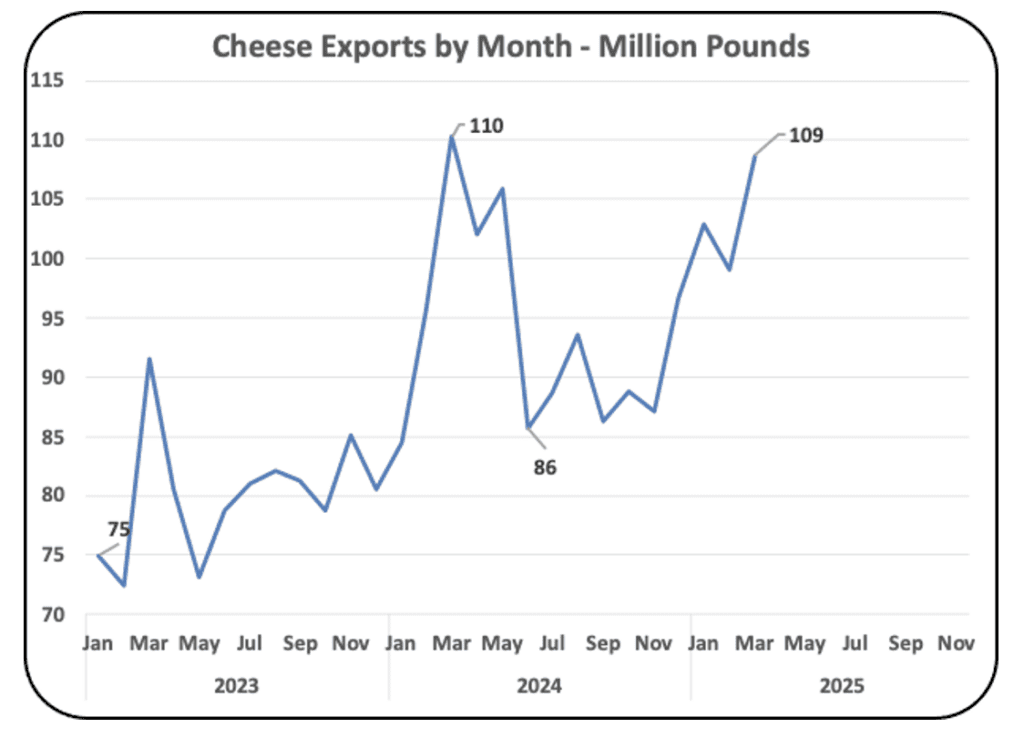

CHEESE EXPORTS

Cheese exports are the largest in terms of dollar amounts. Cheese net exports (Chart III) have increased by 24% in 2024 and 2025. The slight net export decrease in March 2025 is due to increased imports, not decreased exports. Cheese imports are about 1/3 of cheese exports and have shown steady increases.

Chart IV shows the actual monthly exports of cheese which are currently near record levels.

The conclusion for exports of cheese is that it is not showing any decrease in exports caused by the tariff negotiations.

DRY WHEY EXPORTS

Dry whey is a major export item and has almost no imports (Chart V). Dry whey exports have been very steady in 2024 and 2025. The monthly exports in Chart VI show a nice monthly increase in 2025.

China is a major buyer of whey permeate, which they use for feeding swine.

The conclusion for exports of dry whey is that it is not showing any decrease in exports from the tariff negotiations.

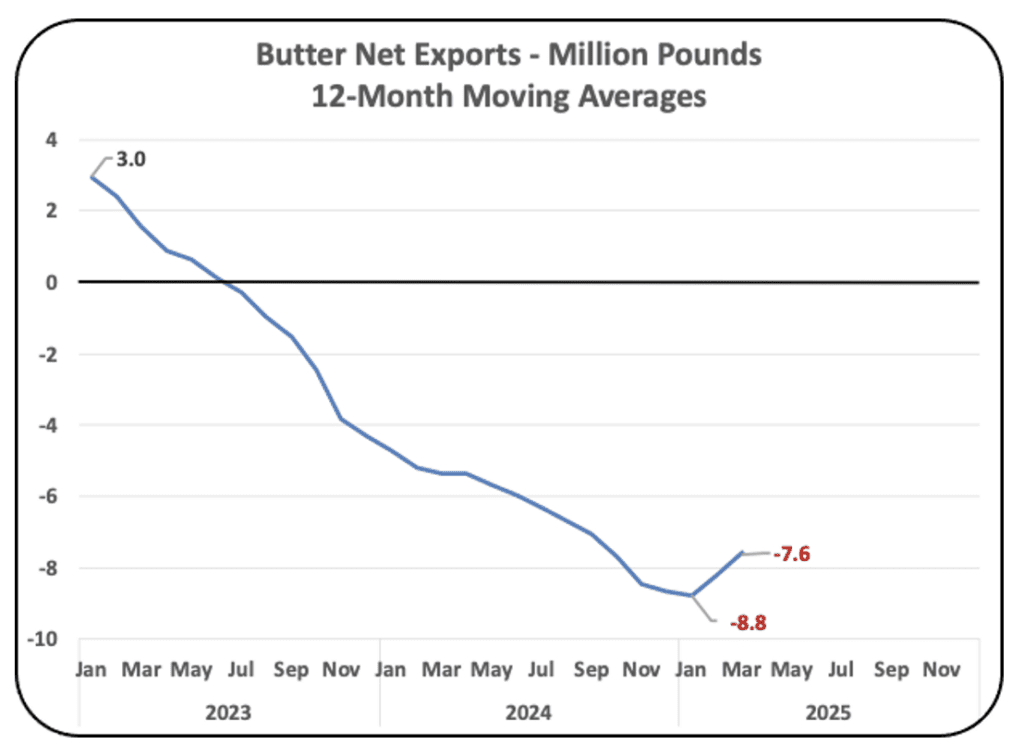

BUTTER EXPORTS

As covered in many prior posts, domestic butter consumption has grown faster than domestic production. As a result, the U.S. is importing butter to make up the difference. Butter imports are twice the size of butter exports. Exports are slightly increasing as the butter production is increasing.

Because butter exports are minimal, the tariff negotiations have not been a factor.

CONCLUSION

There are no signs of the tariff negotiations impacting dairy exports. This will be followed in future posts as new data becomes available. Hopefully, new trade agreements will be finalized in the coming months to eliminate the climate of uncertainty.