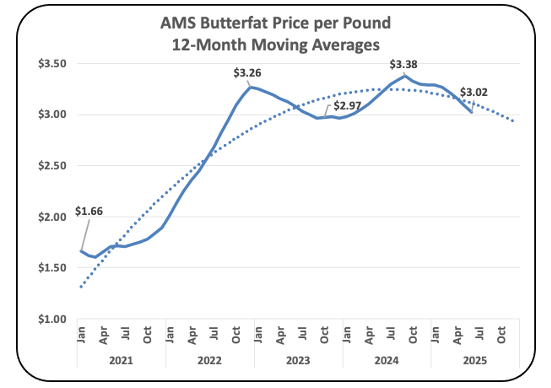

In the last four quarters, the price of butterfat has consistently dropped each quarter from $3.59 to $3.02, to $2.80, to $2.68 per pound (Chart I). Is this a sign of a declining market or is it just normal price variation? The eight charts below review the status of the various items that influence the price of butterfat. Because of the volatility of butter demand and pricing most charts are based on 12-month moving averages.

BUTTERFAT PRICES

Chart I below follows the 12-month average price of butterfat. The Agricultural Marketing Service establishes the butterfat prices using the wholesale price of butter, less the make allowance for churning the butter from butterfat

The price of butterfat shot up in 2021 and 2022 but has been relatively stable since then. Recently, there has been a small downturn. The increase in the make allowance implemented in June will reduce the price of butterfat. (See this recent post for details.)

The increased butterfat price over the span of this analysis is up 81%.

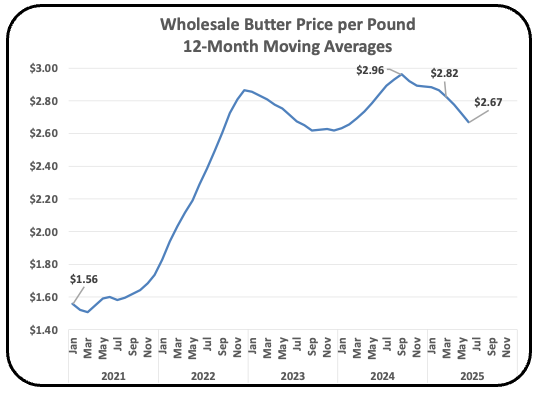

WHOLESALE BUTTER PRICES

Wholesale butter (Chart II) is priced lower than butterfat because it includes an adjustment for water addition. Butter contains 16% to 18% water.

The increase in wholesale butter prices is 71%.

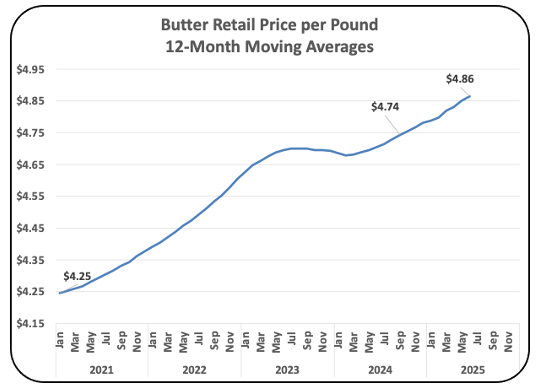

RETAIL BUTTER PRICES

Retail prices add another layer of margin as it gets to the consumer. The retail price of butter is much less volatile and shows continuing increases (Chart III). Groceries do not change prices as fast as the Chicago Mercantile Exchange for commodities does.

The increase in the retail price of butter is just 14%. That is an average annual increase of 3%. While the increase in the retail price is above the food inflation rate (see this prior post), it is still priced at a level that has allowed growth in butter consumption.

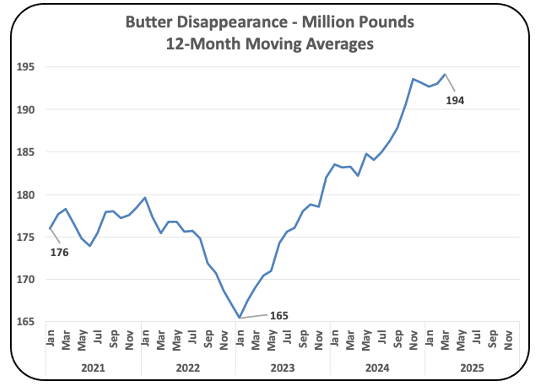

BUTTER CONSUMPTION

Chart IV shows the disappearance of wholesale butter from inventories. Over the last two and a half years disappearance from inventories has grown by 18%. The growth has recently slowed but is still growing to record highs.

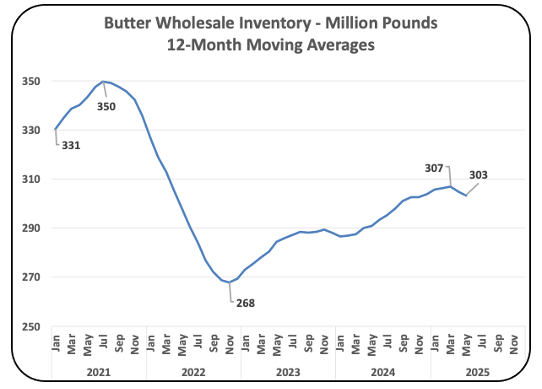

BUTTER WHOLESALE INVENTORY

Butter wholesale inventories have grown only by 5% over the last two and a half years as disappearance grew by 18% over this same time. This has put pressure on inventory levels resulting in higher prices for butter. Currently inventories are not growing.

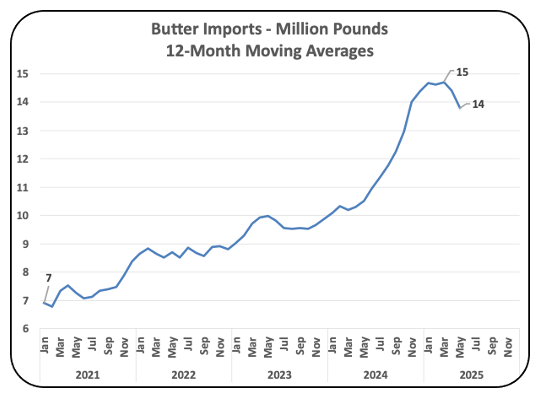

BUTTER IMPORTS

Imports of butter have doubled over the span of this analysis to help supply the growing demand for butter. Import growth has slowed in the last quarter.

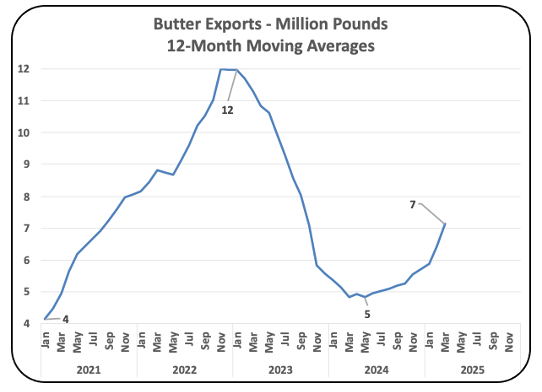

BUTTER EXPORTS

Exports are still minimal compared to imports (Chart VI). Exports are half the volume of imports and are just 4% of butter production. However, over the course of the last 12 months there has been steady growth in exports. Exports occur only when there is enough inventory to supply exports. This increase in exports would suggest that a balance of supply and demand is developing.

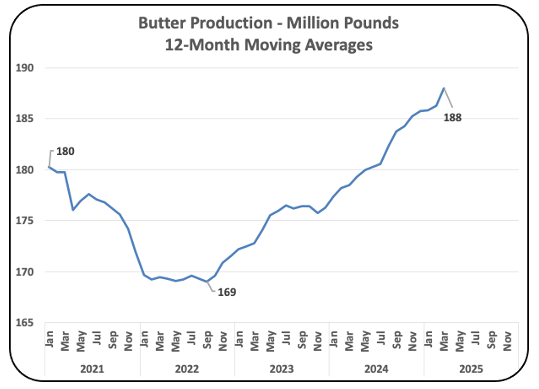

BUTTER PRODUCTION

Butter production has grown by just 11% from its low in2022 (Chart VIII). This is contributing to the supply and demand balance, but it is still not meeting the growth in demand of 18% (Chart IV above).

SUMMARY

The question from all this data is, will supply remain short and prices remain high for butterfat? Domestic butter consumption is growing but at a slower rate. Butter production is increasing at a faster rate. Imports are slowing and exports are growing. But wholesale Inventories are not growing.

Butter supply and demand are moving toward balance but still has a long way to go. Additional production of butter is needed to satisfy increasing domestic consumption.

Expect butterfat prices to remain high for a few more years.