The last two posts, July 30 and August 6, covered exports and Imports of butter and cheese. This post will cover the next two most important exported dairy products, nonfat dry milk (NDM) and whey. Both products are by-products of major dairy products, such as butter and cheese. By-products must find a home. If not, excess quantities will result in lower prices.

The exports and imports are being reviewed to track the changing environment with trade and tariff negotiations. All data used in the three posts are from the U.S. Trade and Tariff Database.

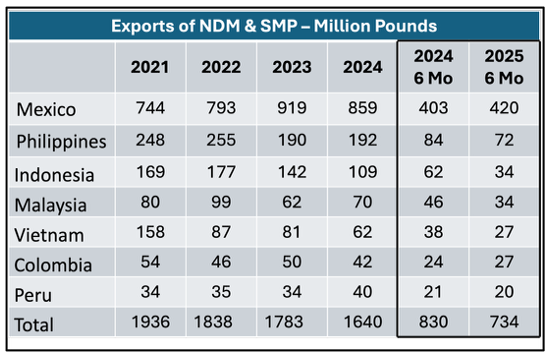

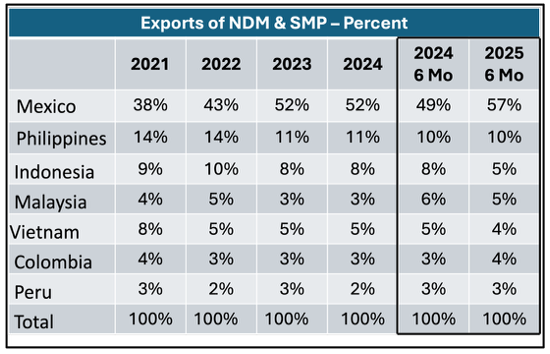

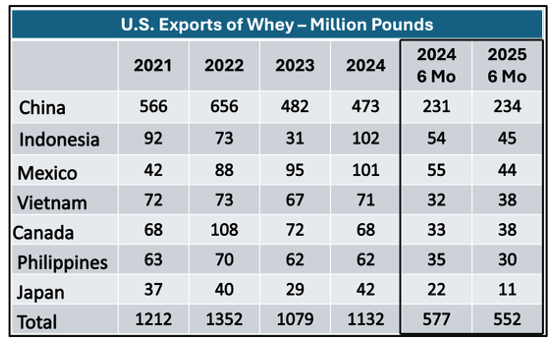

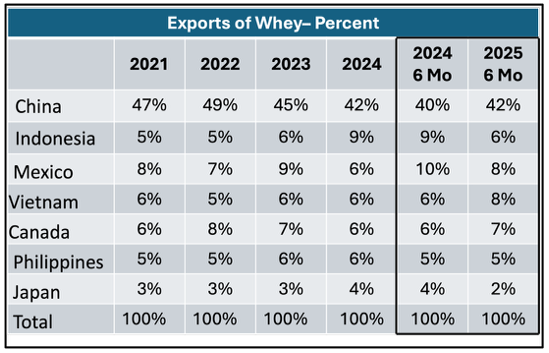

This post focuses on exports. Tables I and III show quantities in pounds, and Tables II and IV show the percent going to the largest seven receiving countries. The quantities and percent exported compare the years 2021 through 2024. The first six months of 2025 will be compared to the first six months of 2024.

EXPORTS OF NONFAT DRY MILK AND SKIM MILK POWDER

Skim milk powder has a larger global use than NDM. The U.S. is the only major producer of NDM, and in terms of U.S. exports, NDM is the major export powder. While it is used domestically in baking formulas, many exports are mixed with water for drinking.

Table I compares where NDM goes and where the export trend is going. Exports of NDM have been declining over the last five years. Mexico is by far the largest importer of NDM, and its volume is growing. It is now consuming over 50% of the NDM exports. The remainder of NDM exports by country amounts to less than 10% each. The seven countries listed below absorb over 80% of the exports.

EXPORTS OF WHEY

Exports of whey are headed mostly to China. Over 40% of the exported whey goes to China. The whey that is sold to China is a slightly different product from conventional whey. The protein in whey has been removed, making the whey into whey permeate. That leaves mostly lactose, which increases the sweet taste in swine diets.

Whey exports are not growing and have declined from 1352 million pounds in 2022 to 1079 pounds in 2023.

IMPACT OF TARIFFS ON EXPORTS OF NDM AND WHEY?

The U.S. exports of NDM and whey are largely dependent on two countries, Mexico and China. Without these partners, half of these exports would collapse. As of now, trade and tariff negotiations have not been finalized. China is very dependent on getting whey permeate, and the U.S. is anxious to sell it. If a tariff were put on NDM going into Mexico, it would increase the price of getting a dairy ingredient essential for youth health. Could the U.S. or Mexico find a different partner with good availability and pricing?

Posts to this source will continue to follow the economic impact of trade and tariff changes on U.S. dairy products.