This post follows the trends of growth in cheese exports and imports based on the U.S. Trade and Tariffs database. The prior post covered imports of butter only. There are very minimal exports of butter due to limited U.S. inventories so there is little to discuss. Exports and imports of cheese are a much larger market with a much bigger impact on the dairy industry.

CHEESE EXPORTS FROM THE U.S

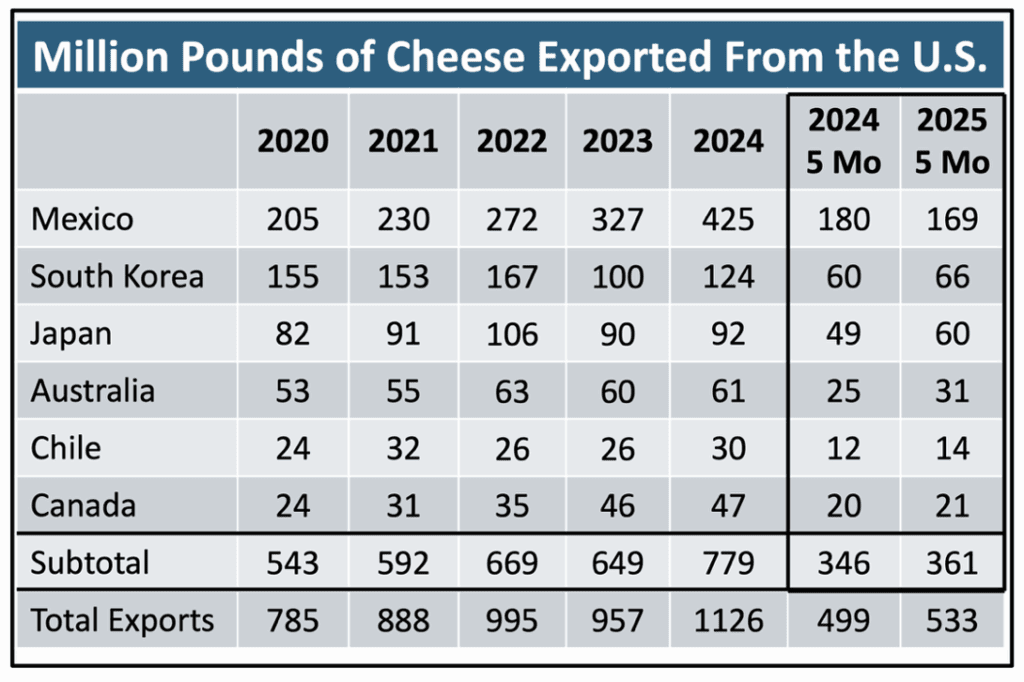

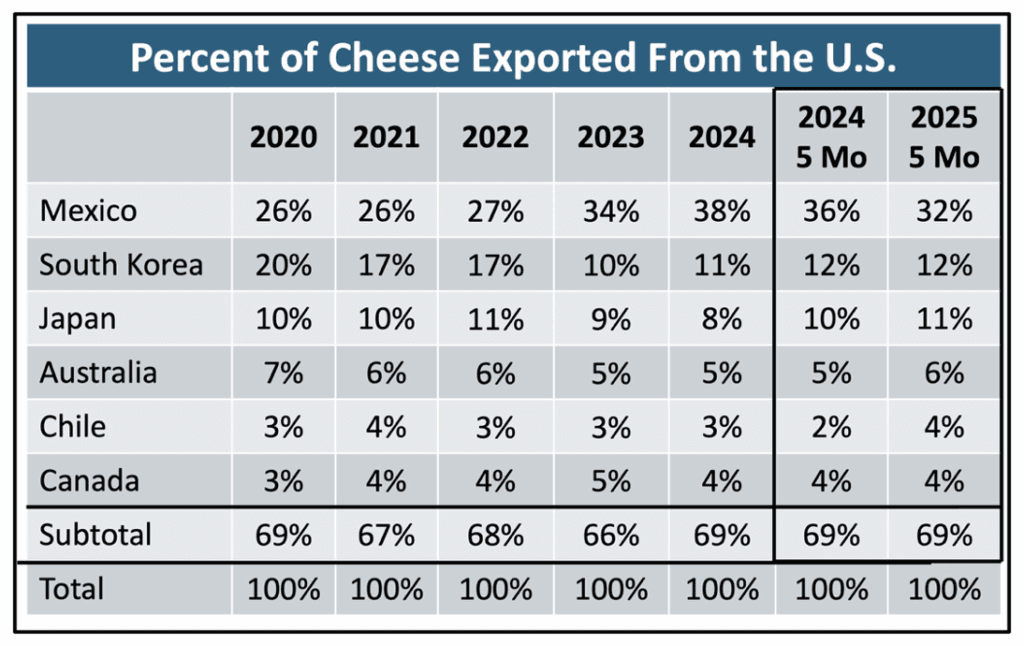

Reviewing the cheese exports over the last five years (Table I), there has been a growth of 43% which amounts to 341 million additional pounds of cheese exported. Cheese exports to Mexico made up 38% of U.S. cheese exports in 2024 (Table II). Cheese exports to Mexico have grown by 107% which amounts to 220 million additional pounds over five years. The growth in Mexico cheese exports makes up 65% of the increase in total cheese export growth.

The two right hand columns in Table I compare the most recent exports of cheese in the first five months of 2025 compared to the first five months of 2024. Overall, the growth of cheese exports in 2025 YTD has grown nicely with a 7% increase. However, Cheese exports to Mexico have fallen by 7% in 2025 YTD. How much of the decrease in Mexico exports is influenced by trade and tariff negotiations? Cheese exports and imports will continue to be followed in future posts as trade and tariff agreements are negotiated.

CHEESE IMPORTS FROM THE U.S

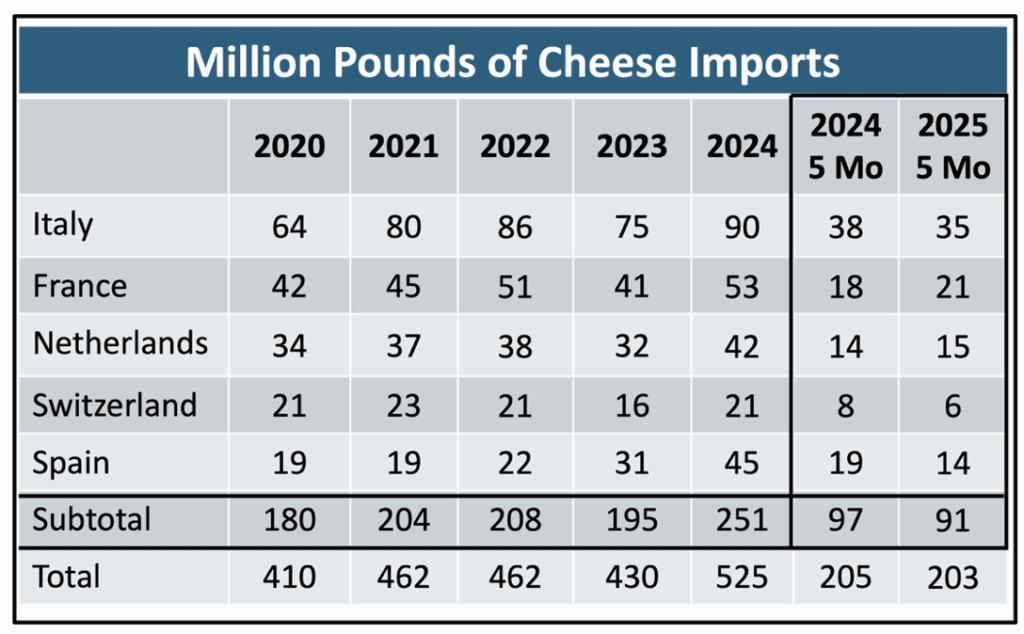

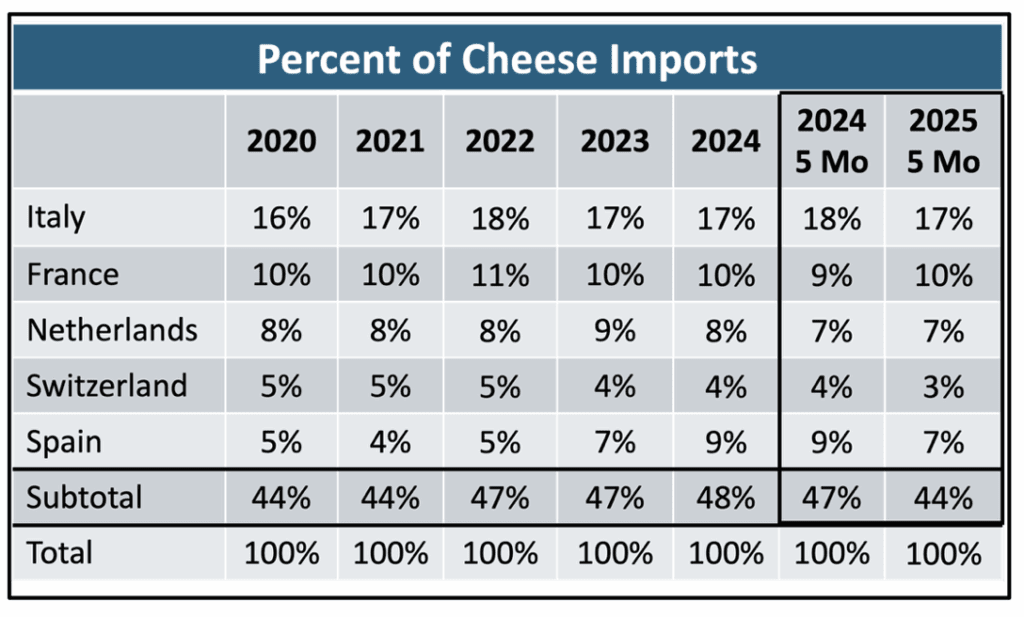

Cheese imports (Table III) to the U.S. are much smaller than exports, leaving a strong growth in net exports. Imports from Italy and France have maintained a very steady 27% of total cheese imports over five years (Table II). The most recent import data for the last five months of 2025 (the two right columns of (Tables III and IV) show no significant change between 2024 and 2025.

Total cheese imports have grown by 28% over five years which amounts to 115 million additional pounds of cheese imports.

Imports of specialty cheeses made in Italy and France remain steady as a percent of total cheese imports (Table IV).

CONCLUSION

This post sets the basis to measure the impact of trade and tariff realignments. The main impact will be on imports. The proposed tariff changes would impact the cost of imported cheese, especially from the EU which is a major U.S. cheese importer. The import tariffs will increase prices of these EU cheeses by 15%.

If that decreases purchases of imported cheese, it could result in increases of American cheese, but the branding of the EU cheese does carry strong purchasing power.

A significant concern is the current drop in cheese exports with the largest U.S. customer, Mexico. After five years of growing cheese exports to Mexico, the cheese exports to Mexico are now declining.