Producer revenue is very dependent on the wholesale prices for dairy products. The USDA conducts weekly surveys and then averages them to provide the basis for the monthly values paid for Federal Order milk. This post will cover the trends beginning in January 2023 and through the most recent weekly prices for these dairy products.

CHEESE AND CLASS III MILK

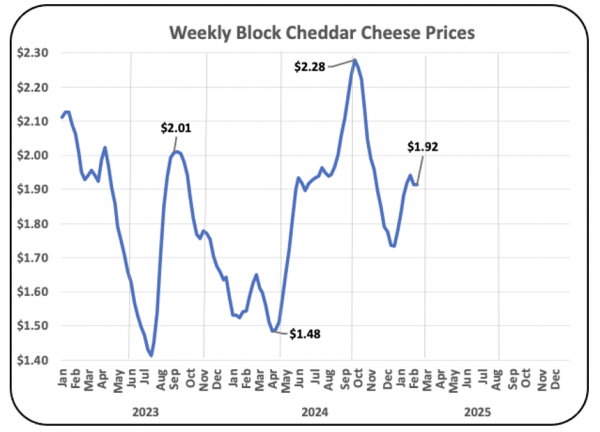

Cheese prices are important as they have a major impact on Class III milk prices. Class III milk makes up 54% of Federal Order milk. With the new USDA formulas, which will soon be implemented, the cheese prices will be based on block Cheddar cheese only. Cheese prices are the major commodity for pricing milk protein.

Chart I below plots the last 113 weekly prices for Block Cheddar cheese. The pricing has varied from $1.41 per pound to $2.28 per pound, a 62% spread. Cheddar cheese prices in 2024 increased significantly and then fell at the end of 2024. In 2025 the price has been increasing and is currently at $1.92 per pound.

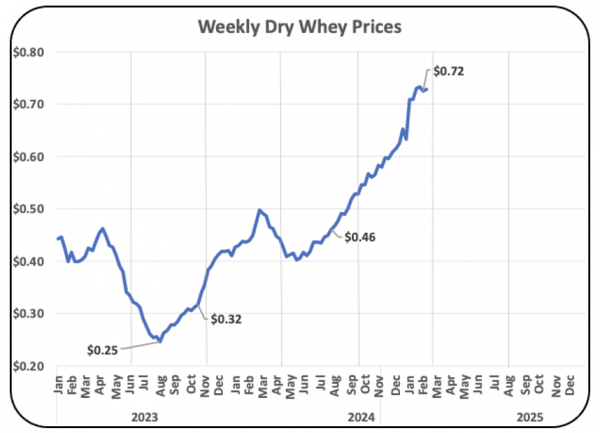

Whey (Chart II) is a byproduct of cheese making. A part of the Class III price is based on the amount and value of Whey that has been dried. The major component that is in whey is lactose. The price of dry whey has more than doubled from late 2023 to the present and is still growing. Higher prices for dry whey mean higher Class III prices for producers. The country that buys the most whey from the U.S. is China. They use it to increase consumption in pigs by sweetening their feed.

BUTTER AND CLASS IV MILK

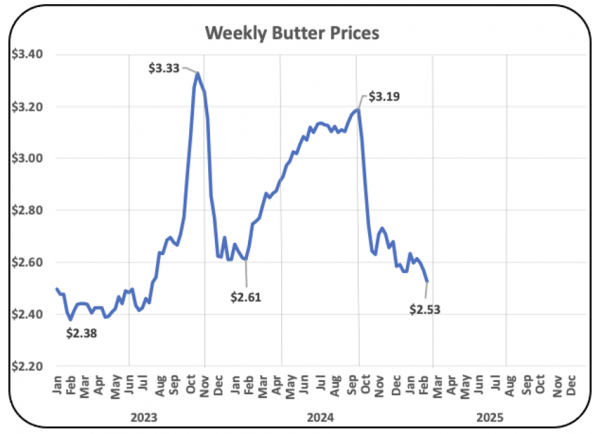

Butter consumption is increasing (See this post for details), and with higher demand, butter prices shot up to record highs with at 33% gain in October 2024 (Chart III below). Increased butter prices and increased levels of butterfat in milk have contributed significantly to producer revenue. Production is now catching up and prices are dropping. The prices will likely continue to fall as butter production catches up with demand.

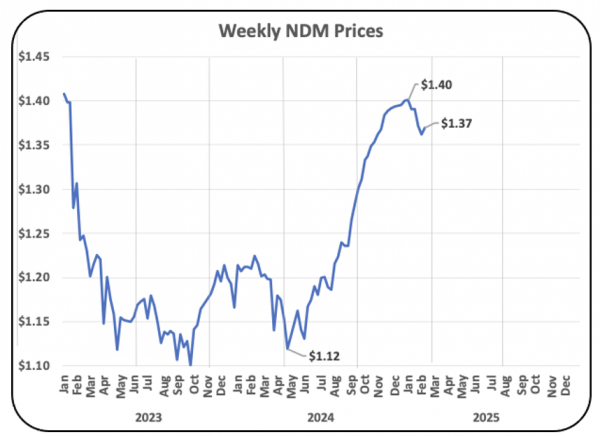

As producers use more milk for butter, that leaves protein and “other solids” to sell. The largest use of this is for nonfat dry milk (NDM). The increases in the price of NDM (Chart IV below) combined with the high price for butterfat is keeping Class IV milk prices high.

CONCLUSION

As the price of butter decreases, the price of milk protein in Class III milk increases. With the increase in cheese prices covered above, combined with decreasing butter prices, January 2025 prices for Class III milk increased from January 2024 by 34% which is $5.17 per cwt. This is a huge increase in producer revenue for Class III milk.

Class IV prices increased slightly in January 2025 compared to January 2024. The January 2025 Class IV price of $20.73 per cwt. was an increase of $1.34 per cwt. from January 2024. The butterfat value in Class IV dropped by $.16 per pound, but the skim milk increased by $1.50 per cwt. with the increase in the NDM prices.

The next post will review the trends in the four Classes of milk.