Higher levels of butterfat and milk protein increase producer revenue and help meet the dairy domestic consumption with fewer cows. The increase of these components has been steady. Are they reaching a limit? Is the growth slowing? This post will cover the changes in the first quarter of 2025.

Overall, the growth continues to be amazing. No Federal Order shows a decline in butterfat or milk protein levels. However, the differences between Federal Orders indicate that some areas have a great opportunity to increase their component levels and increase revenue.

All data is based on 12-month moving averages to eliminate monthly volatility and seasonal fluctuations.

BUTTERFAT

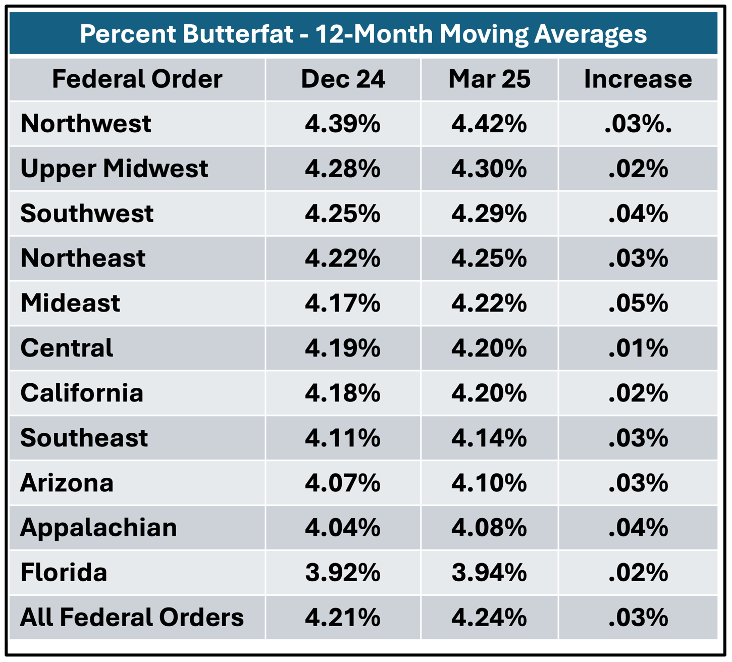

Table I below lists the current levels of butterfat and the amount of increase for each Federal Order in the first quarter of 2025. Every Federal Order continues to show steady growth. The four Federal Orders paid by the Advanced pricing formulas continue to have the lowest levels of butterfat with Florida, the highest paid Federal Order, at the bottom of the list. Implementing the technologies used by the other Federal Orders could be very impactful. The lowest Federal Order paid by the Class and Component formulas is California. While California feeding is unique, considering that one third of U.S. butter is churned in California, there is potential for improvement. One of the very consistent patterns is that each Federal Order continues to increase the butterfat levels. As covered in the prior post, there is a not enough butterfat being produced to meet domestic butter consumption. Increased butterfat levels will help balance this.

Chart I below follows the increase in butterfat levels over five years. The increases have been very steady with almost no decreases. The trend line shows an increasing monthly rate of higher butterfat levels.

MILK PROTEIN

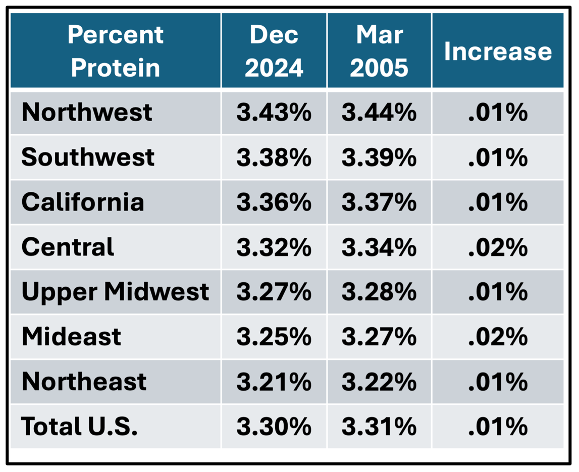

Milk protein levels also show steady growth. The growth is slower than butterfat as milk protein is only paid for Class III milk and protein prices have been lower than butterfat. The Federal Order rankings below, show that there is opportunity for growth in protein levels in many Federal Orders.

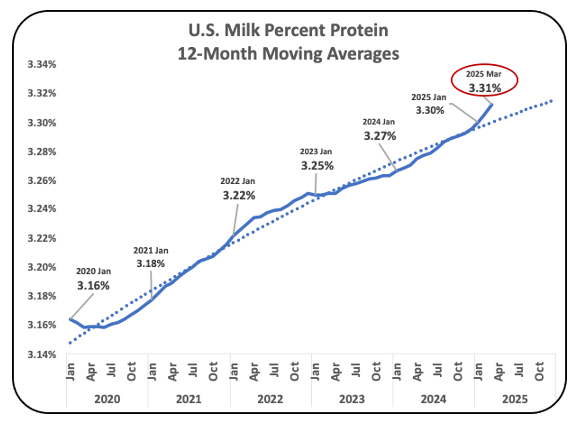

Chart II shows the long-term growth of milk protein levels. In 2020 there was a decrease impacted by COVID mandates, but since then, the increases have been steady. In the first quarter of 2025, the rate of increase made major gains.

NONFAT SOLIDS

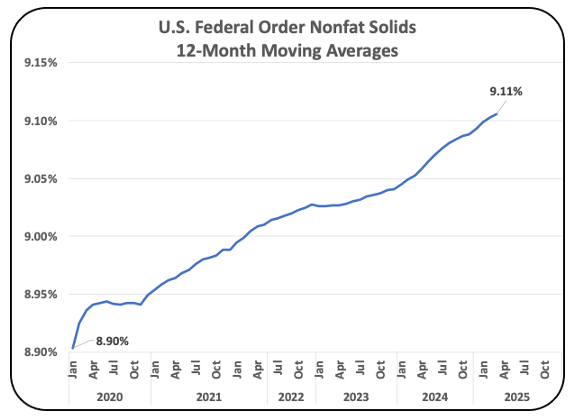

Chart III below shows the growth in Nonfat Solids, paid for Class IV milk. They are primarily growing based on increases in milk protein volumes. California, being the largest producer of butter, benefits the most from increased levels of Nonfat Solids.

IMPACT

Increasing components is key to successful dairy operations. There is one other key element to a successful dairy business, milk per cow. First quarter 2025 changes in milk per cow will be covered in the next post to this series. There is no slowing of the rate of increases in butterfat or milk protein. Continued increases can be expected.