A recent article has stated that we have a “glut of cream” and need to expand butter exports. Data from reliable sources indicates the opposite. Domestic demand for butter shows no weakness, wholesale inventories of butter are low, we are importing butter to meet demand, and exports are low due to a lack of inventory.

Data used in this post is from the USDA and BLS. All charts are based on 12-month moving averages due to the strong annual cycle of butter demand.

The main use of butterfat is for cheese. Cheese is a stable and healthy market with reasonable retail prices. Domestic butter consumption is growing. Fluid milk is using more butterfat as whole milk consumption continues to increase. Producer component levels for butterfat continue to increase. Producer revenue is primarily from butterfat.

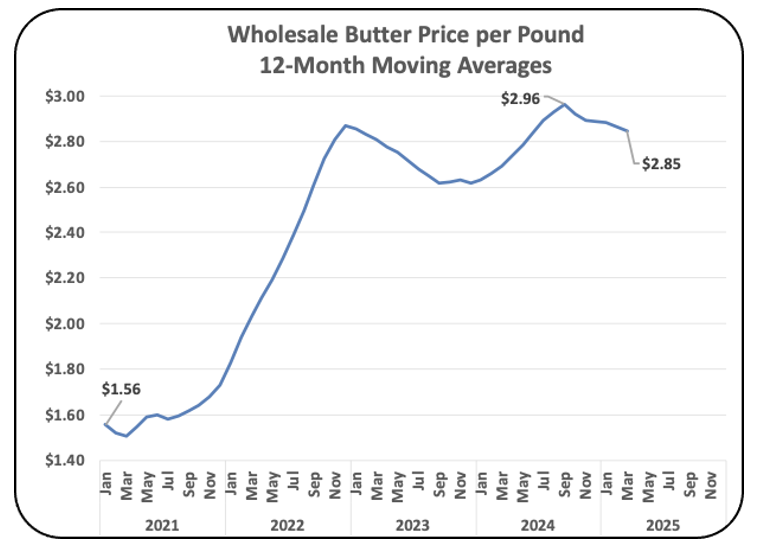

The U.S. dairy market pricing is based on financial capitalization. Prices result from supply and demand. A clear example is the current price of butter and butterfat. Butter Inventories are low and prices are high, and producers are expanding production of butterfat to meet demand.

Here’s the facts.

Butter Inventories have grown over the last two years by 14% (Chart I).

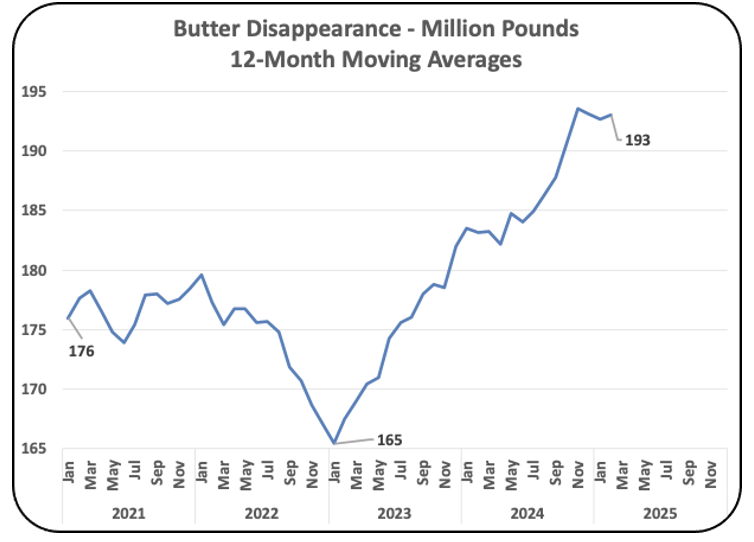

Butter withdrawals from inventory are growing by 17% (Chart II).

Because withdrawals from butter inventory are growing faster than butter production, the months of supply has decreased to 1.6 months and remains low (Chart III).

To meet domestic demand, U.S. butter production is up by 10% (Chart IV), but that is not enough to meet demand.

To improve supplies the U.S. is importing more butter, as shown in the Chart V below. Imports are up by 110%. The 12-month moving average of imports is at record highs.

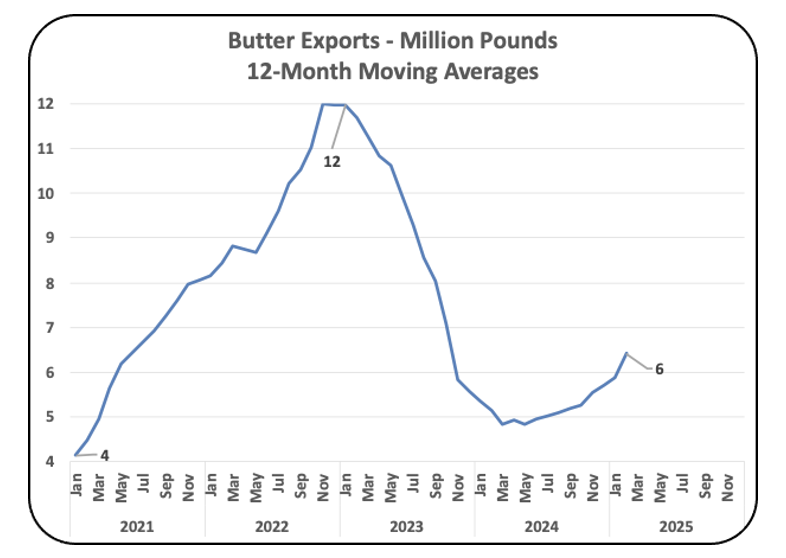

Exports are down by 50% because available inventories are short (Chart VI).

Because butter inventories are low, wholesale butter prices from inventory are reaching record highs (Chart VII).

Because wholesale prices are at record high, retail prices are also higher (Chart VIII).

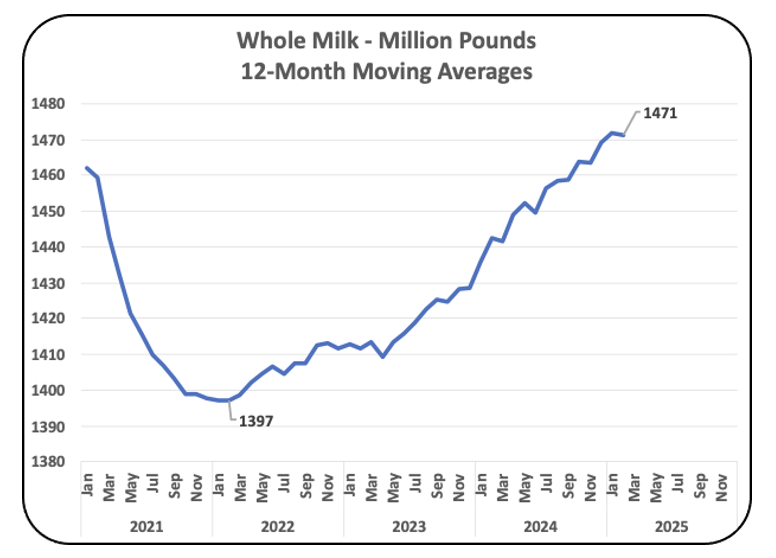

Sales of whole milk have increased by 5%. Sale of 2% fat milk have decreased by 6% over the same period.

Do we have a “glut of cream” (butterfat)? No, the U.S. production of butterfat is still increasing to meet domestic demand. The fear of saturated fats is being replaced by the benefits of consuming dairy products. When domestic demand is met, prices of butter and butterfat will decrease. With that, the increased need for butterfat will slow, but will not decrease. Capitalism does work.

Other recent posts have covered butter availability and pricing.

February 6, 2025 – Is Demand for Producer Milk Increasing?

February 28, 2025 – Butter, Butter, Butter

January 16, 2025 – Is U.S. Milk Production Increasing?

November 15, 2024 – Butter, Butter, Butter