The wholesale commodity prices of Cheddar cheese, butter, dry whey, and nonfat dry milk (NDM) control producer prices. There is constant news on every price move for these commodities, including future movements and the weekly and monthly posts of the Agriculture Marketing Service (AMS). Weekly and monthly movements can be very volatile. Short-term and long-term trends of actual prices can provide a more accurate estimate of future pricing movements.

This post will review the trends in these commodities based on the AMS weekly price changes over 52-week moving averages. By using the moving 52-week averages, individual changes and seasonal fluctuations are minimized. It clarifies where prices are going based on where they are coming from.

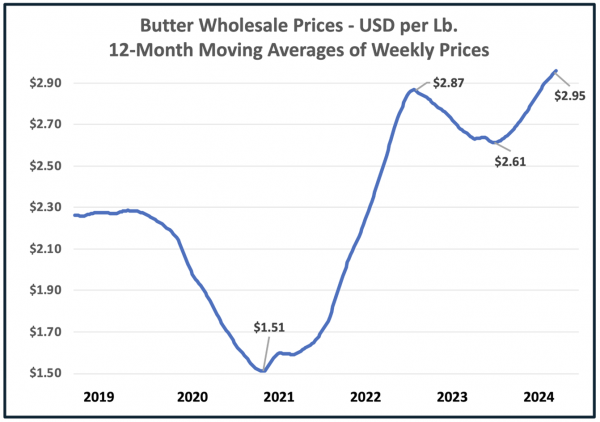

BUTTER

Butter price trends continue to show gains (Chart I). The 52-month moving average is now at $2.94 per pound. At the beginning of 2024, weekly butter prices dipped to $2.61 per pound. Butter prices have averaged $3.13 per pound in the last three months. In the third week of September, they hit a near-record price of $3.19 per pound.

The annual data and recent prices continue to show high prices for butter and, therefore, butterfat.

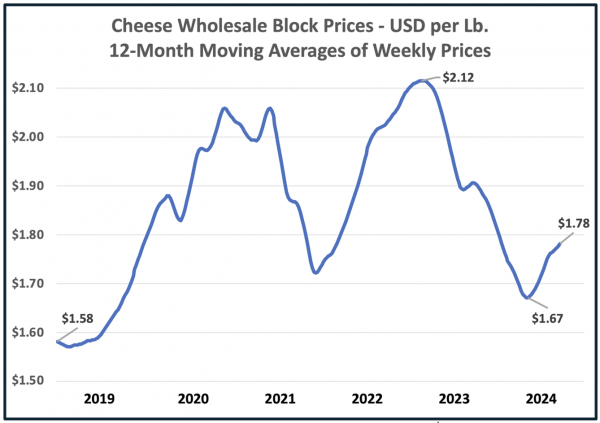

CHEESE

The new USDA standard for cheese will be based on the prices of Block Cheddar cheese only. Therefore, the movement of prices shown in Chart II is based on only Block Cheddar cheese prices. Over the course of the last six years, these prices have increased by just 9%. Retail prices have increased much more and will be reviewed in a separate post.

The 2020 and 2021 years were clouded by the mandates implemented for COVID. However, in 2022 prices rose dramatically. In 2023 and 2024 the prices declined to a low of $1.67 per pound. The positive movement seen in 2024 has increased cheese prices to $1.78 per pound.

What can be expected in the near term? In the last three months, block cheese prices have averaged $2.04 per pound and are trending upward. In the fourth week of September the cheese price hit $2.28 per pound, a near record high. Prices can be expected to be above $2.00 per pound in the near term.

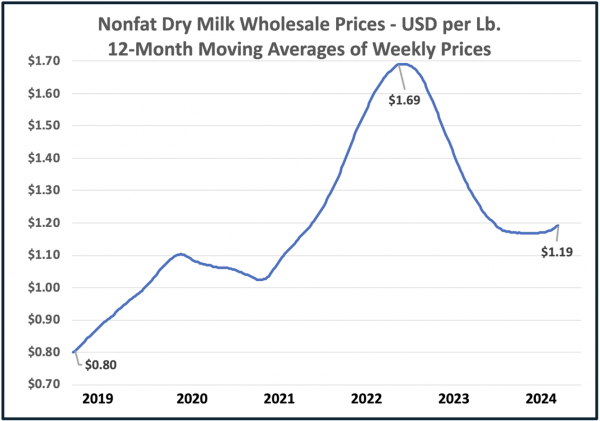

NDM

NDM is primarily an export product with the largest exports going to Mexico. It is an important commodity, as it is used to price Class IV skim milk. In 2023, prices reached a high of $1.69 per pound but it has now declined to $1.19 per pound. NDM is a byproduct of butter churning. It must be sold at whatever price it can get. Pressure for more butter churning will leave more NDM to find a home. Prices will continue to be low.

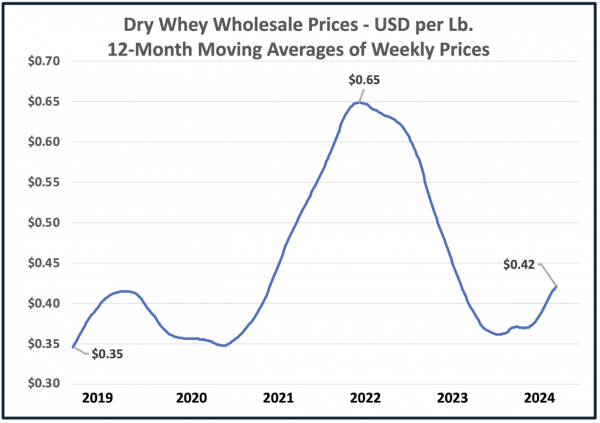

DRY WHEY

Dry whey has a small impact on only Class III milk pricing. Dry Whey has significant exports, primarily to China. After a high in 2022, the price of dry whey has fallen by nearly 50%. The weekly prices are showing some increases but will continue well below the 2022 high.

18 Responses

Your point of view caught my eye and was very interesting. Thanks. I have a question for you. https://www.binance.com/hu/register?ref=IQY5TET4

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me. https://accounts.binance.info/register-person?ref=IHJUI7TF

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me. https://www.binance.info/register?ref=IHJUI7TF

Your article helped me a lot, is there any more related content? Thanks!

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

**prodentim official website**

ProDentim is a distinctive oral-care formula that pairs targeted probiotics with plant-based ingredients to encourage strong teeth, comfortable gums, and reliably fresh breath

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://accounts.binance.com/en/register-person?ref=JHQQKNKN

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Your article helped me a lot, is there any more related content? Thanks!

Your point of view caught my eye and was very interesting. Thanks. I have a question for you. https://www.binance.info/register?ref=IXBIAFVY

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me. https://www.binance.info/pt-PT/register?ref=KDN7HDOR

Your point of view caught my eye and was very interesting. Thanks. I have a question for you. https://accounts.binance.com/de-CH/register-person?ref=W0BCQMF1

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.