The Northeast Federal Order has done a good job of minimizing de-pooling in their Order (See the charts in a recent Post). Additionally, the USDA changes implemented in June will make it difficult to gain any benefits by de-pooling in all 11 Federal Milk Orders. This post will cover the USDA changes to minimize de-pooling and will cover the techniques used in the Northeast Federal Order to minimize de-pooling.

USDA CHANGES THAT WILL MINIMIZE DE-POOLLING THOUGHOUT ALL FEDERAL ORDERS

The opportunity to gain financially with de-pooling occurs when the Class I milk price is lower than the Class III (or Class IV) in an Order. This results in a negative Producer Price Differential which in turn makes de-pooling the highest paid Class of milk advantageous. The de-pooling disrupts the purpose of a Federal Order system by increasing the payment for the milk de-pooled and decreasing the payment for those left in the pool (see this prior post). How can this be stopped? The USDA pricing changes implemented in June will significantly reduce de-pooling.

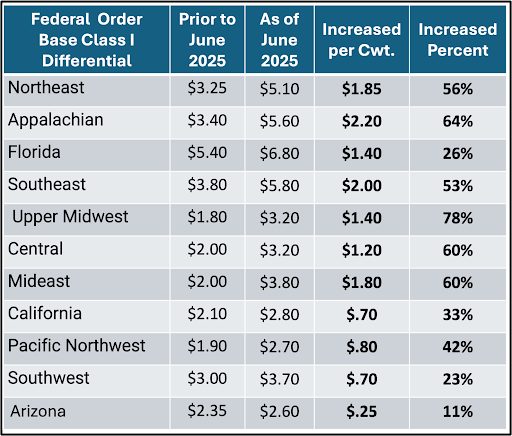

In Table I below are the changes in the “Class I Differentials.” “Class I Differentials” were designed to make sure that there is enough milk reaching dense population areas where fluid milk is needed. The large increases in the “Class I Differentials” make Class I milk higher priced.

Additionally, the skim price of Class I milk has been revised back to the higher of Class III or Class IV skim milk. The math is simple. When the Class I skim milk is priced equal to the higher of Class III or Class IV skim milk and additionally gets a large “Class I Differential” it is impossible to have a negative Producer Price Differential.

Table I below shows the increases in the “Base Differentials.”

The east coast Federal Orders which include Florida, the Southeast, Appalachian, and Northeast orders have the highest “Class I Differentials”. The “Class I Differentials” for these Orders range from $5.10 To $6.80 per cwt. Florida’s differential is $6.80. Florida’s producer milk prices have always been the highest of any Federal Order, and they will now have a further lead in pricing. The Northeast Order which already has minimal de-pooling will now have even less de-pooling.

The western Federal Orders which include the Southwest, California, Arizona and the Pacific Northwest, have negotiated smaller changes in the “Differential” increases and now have Class I “Differentials” ranging from $2.60 to $3.70.

THE NORTHEAST FEDERAL ORDER RULES FOR DE-POOLING.

The Northeast Federal Order has used a technique that Federal Orders allows to minimize de-pooling. The Northeast has made de-pooling difficult by having re-pooling rules that deny acceptance to the pool for a period if milk is de-pooled.

Handlers who de-pool face restrictions on when they can re-join the pool and the policy also includes a possible financial penalty in addition to compensate for “pool losses” caused by de-pooling. The period before re-pooling ranges from one month to many months.

If a handler or cooperative de-pools a farmer’s milk at any time during the low production months of July through November, that farmer’s milk is prohibited from participating in the pool during the subsequent high production months of December through June.

SUMMARY

The recent changes to higher “Class I milk differential” prices are expected to significantly reduce financial de-pooling. The Northeast may still use their re-pooling rules to further minimize de-pooling.

This post will continue to follow the impact of changes in de-pooling in each Federal Order. California did de-pool a lot of Class IV milk in June.

Other recent posts are available at this link, and older posts are available at this link.