Exports feed demand for dairy products. An increase in exports can pressure inventories and increase prices. An increase in imports reduces domestic demand and can lower prices. This post will review exports and imports of key dairy products. Because exports and imports can be volatile month-to-month, this post will use 12-month moving averages. The dotted lines are trend lines.

Butter

The first dairy product to be covered is butter. Butter prices have set record highs. As covered in the prior post, butterfat prices and component levels are driving attractive producer prices for milk. Butterfat is currently worth $3.77 per pound.

Exports have tumbled in 2023 and 2024 (Chart I). As a result, net exports are negative by 5,400,000 pounds and imports total 10,300,000 pounds which is 5% of U.S. butter production.

Imports have continued to steadily increase doubling over in the last seven years. The main import sources are Ireland and New Zealand.

Cheese

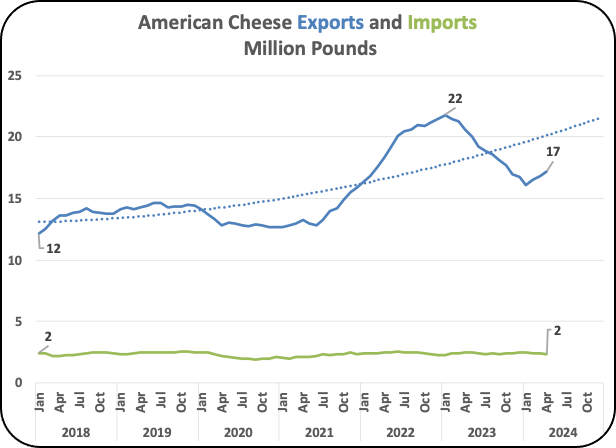

Cheese exports have also fallen in 2023 and 2024 (Chart II). The drop is 23%! Currently, American cheese exports are only 2% of domestic production. The long-term trend line does show growth and in the most recent three months cheese exports have increased.

Imports have remained very stable over the seven years covered in this chart.

Producer prices are based on the price of Cheddar cheese which makes up the majority of American cheese.

Dry Whey

No dry whey is imported. Therefore, Chart III compares exports to domestic use. Export trends have declined in 2023 and 2024. The most significant buyer is China. Dry whey is really a byproduct of cheese production and is used to price “Other Solids” in Class III milk. There must be a market for dry whey so when exports decline, domestic usage must increase as seen in the mirror images in Chart III. Unfortunately, as a result of lower exports, prices have decreased in 2023 and 2024.

Nonfat Dry Milk

Nonfat dry milk (NDM)and skim milk powder (SMP) are byproducts of butter production. Like dry whey, it must find a market (Chart IV). There are essentially no imports, so the comparison in Chart IV compares exports to domestic use.

Domestic use has gradually slowed. Exports of NDM/SMP have followed the pattern of the above products with declines in 2023 and 2024. NDM production is double SMP production. Ninety percent of NDM is exported. NDM does have a long shelf life, so it can be stored when exports are low. However, as inventories grow, prices fall.

NDM prices change the value of Class IV skim milk and declining exports lower prices. Skim Class IV milk has decreased from $14.82 per cwt. in April 2023 to the current price of $9.13 per cwt. As the skim milk is worth less, the profitability of churning butter decreases. That may have an impact on the volume of butter churning.

Summary

Unfortunately, exports of all dairy products used to price producer milk have downward trends in 2023 and 2024. That reduces demand. In the case of butter, the decrease in exports of NDM/SMP can result in limited churning production which lowers inventories and increases butter prices.

897 Responses

Great article! I really appreciate the clear and detailed insights you’ve provided on this topic. It’s always refreshing to read content that breaks things down so well, making it easy for readers to grasp even complex ideas. I also found the practical tips you’ve shared to be very helpful. Looking forward to more informative posts like this! Keep up the good work!

Hi! Do you know if they make any plugins to help with SEO?

I’m trying to get my site to rank for some targeted keywords but I’m not seeing

very good results. If you know of any please share.

Cheers! You can read similar blog here: Eco product

Sugar Defender Reviews Incorporating Sugar Protector

right into my day-to-day routine has been a game-changer for my general well-being.

As a person that currently prioritizes healthy eating,

this supplement has actually supplied an included boost of protection. in my energy degrees, and my wish for undesirable treats

so simple and easy can have such an extensive impact on my

day-to-day live. sugar defender official website

sugar defender official website Adding Sugar Defender to my day-to-day regimen was just one

of the very best decisions I’ve produced

my health and wellness. I take care concerning what I eat, however this supplement adds an added layer of support.

I really feel more consistent throughout the day, and my food cravings have actually decreased dramatically.

It behaves to have something so simple that makes such a

large difference! sugar defender

Hi there! This article could not be written any better! Looking at this article reminds me of my previous roommate! He constantly kept talking about this. I will send this post to him. Fairly certain he’ll have a great read. Many thanks for sharing!

Great info. Lucky me I came across your blog by chance (stumbleupon). I have book-marked it for later!

Hello there, There’s no doubt that your website may be having internet browser compatibility issues. Whenever I look at your website in Safari, it looks fine however when opening in IE, it has some overlapping issues. I just wanted to give you a quick heads up! Besides that, excellent blog.

I have to thank you for the efforts you’ve put in penning this blog. I am hoping to view the same high-grade content by you later on as well. In truth, your creative writing abilities has motivated me to get my own, personal blog now 😉

May I just say what a comfort to discover someone who actually understands what they are talking about on the web. You certainly know how to bring an issue to light and make it important. More people should read this and understand this side of the story. I can’t believe you’re not more popular since you definitely have the gift.

Way cool! Some extremely valid points! I appreciate you penning this article and the rest of the website is also really good.

Oh my goodness! Incredible article dude! Thank you so much, However I am having difficulties with your RSS. I don’t understand why I can’t join it. Is there anybody having the same RSS issues? Anyone that knows the solution can you kindly respond? Thanx!!

Aw, this was an extremely nice post. Taking the time and actual effort to make a very good article… but what can I say… I hesitate a whole lot and don’t manage to get anything done.

This excellent website really has all the information and facts I needed concerning this subject and didn’t know who to ask.

Excellent web site you have got here.. It’s hard to find quality writing like yours these days. I really appreciate people like you! Take care!!

You are so interesting! I do not suppose I’ve read something like this before. So wonderful to discover somebody with original thoughts on this topic. Seriously.. thank you for starting this up. This web site is one thing that is needed on the internet, someone with some originality.

Oh my goodness! Incredible article dude! Many thanks, However I am going through troubles with your RSS. I don’t know why I am unable to subscribe to it. Is there anybody having the same RSS issues? Anybody who knows the answer will you kindly respond? Thanks.

Hi, I do think this is an excellent site. I stumbledupon it 😉 I’m going to return once again since I book-marked it. Money and freedom is the greatest way to change, may you be rich and continue to guide other people.

Next time I read a blog, Hopefully it does not disappoint me just as much as this particular one. After all, I know it was my choice to read through, nonetheless I really believed you would probably have something helpful to say. All I hear is a bunch of whining about something you could possibly fix if you were not too busy looking for attention.

A motivating discussion is definitely worth comment. There’s no doubt that that you need to publish more on this subject matter, it might not be a taboo subject but typically folks don’t speak about these issues. To the next! Best wishes!

It’s nearly impossible to find knowledgeable people on this topic, but you sound like you know what you’re talking about! Thanks

This is a topic which is close to my heart… Cheers! Exactly where are your contact details though?

Pretty! This was a really wonderful article. Thank you for providing this info.

sugar defender ingredients Sugarcoating Protector to my daily routine was one of the best decisions I’ve produced my health and

wellness. I beware concerning what I consume, however this supplement adds an extra layer of support.

I feel more constant throughout the day, and my food cravings have decreased considerably.

It’s nice to have something so easy that makes such a big distinction!

I was very happy to find this web site. I wanted to thank you for ones time just for this fantastic read!! I definitely loved every bit of it and i also have you book-marked to see new stuff on your web site.

An interesting discussion is definitely worth comment. There’s no doubt that that you should write more on this issue, it may not be a taboo matter but usually people don’t talk about such subjects. To the next! Best wishes.

I really like it when individuals get together and share ideas. Great site, continue the good work.

I needed to thank you for this fantastic read!! I certainly enjoyed every bit of it. I’ve got you book marked to check out new stuff you post…

Greetings! Very helpful advice within this article! It’s the little changes that make the largest changes. Thanks a lot for sharing!

I used to be able to find good information from your articles.

Everything is very open with a clear clarification of the challenges. It was definitely informative. Your site is very useful. Thank you for sharing.

Right here is the perfect site for everyone who wishes to find out about this topic. You realize a whole lot its almost hard to argue with you (not that I really would want to…HaHa). You definitely put a fresh spin on a subject that has been discussed for a long time. Great stuff, just wonderful.

Good post. I learn something totally new and challenging on blogs I stumbleupon every day. It’s always useful to read through content from other authors and practice a little something from other sites.

I’m amazed, I have to admit. Seldom do I come across a blog that’s equally educative and amusing, and without a doubt, you’ve hit the nail on the head. The issue is something too few men and women are speaking intelligently about. I am very happy I stumbled across this in my search for something relating to this.

Can I just say what a relief to discover somebody that actually knows what they are discussing on the internet. You definitely realize how to bring an issue to light and make it important. More people really need to check this out and understand this side of the story. I can’t believe you’re not more popular because you surely possess the gift.

I’m impressed, I have to admit. Seldom do I encounter a blog that’s equally educative and interesting, and let me tell you, you’ve hit the nail on the head. The issue is an issue that too few men and women are speaking intelligently about. I’m very happy that I stumbled across this during my hunt for something concerning this.

There is certainly a great deal to know about this subject. I love all the points you made.

This is a topic that’s near to my heart… Thank you! Exactly where can I find the contact details for questions?

Very nice write-up. I definitely appreciate this website. Continue the good work!

You are so awesome! I do not think I’ve truly read through anything like that before. So nice to find somebody with original thoughts on this topic. Really.. many thanks for starting this up. This website is one thing that’s needed on the internet, someone with some originality.

Good post. I definitely appreciate this site. Keep writing!

Everyone loves it when individuals come together and share thoughts. Great blog, keep it up.

You just want to be somewhere else or actually playing the game.

bookmarked!!, I love your web site.

After checking out a handful of the blog posts on your site, I honestly like your way of blogging. I book marked it to my bookmark website list and will be checking back in the near future. Take a look at my website too and let me know your opinion.

You made some respectable points there. I looked on the internet for the difficulty and found most people will go along with along with your website.

Good website! I truly love how it is simple on my eyes and the data are well written. I am wondering how I could be notified whenever a new post has been made. I’ve subscribed to your RSS which must do the trick! Have a nice day!

You should take part in a contest for one of the highest quality sites online. I will highly recommend this site!

Nice post. I find out something very complicated on diverse blogs everyday. It will always be stimulating you just read content off their writers and practice a little there. I’d would rather use some using the content on my small blog regardless of whether you do not mind. Natually I’ll supply you with a link for your web weblog. Appreciate your sharing.

You are so interesting! I do not believe I’ve truly read through a single thing like this before. So good to discover someone with genuine thoughts on this subject. Really.. thank you for starting this up. This website is something that is needed on the internet, someone with some originality.

i am using infolinks and chitika and i think infolinks have the best payout ,.

Spot on with this write-up, I seriously think this amazing site needs far more attention. I’ll probably be back again to read through more, thanks for the info.

I absolutely love your site.. Pleasant colors & theme. Did you make this website yourself? Please reply back as I’m wanting to create my very own site and would love to learn where you got this from or exactly what the theme is named. Cheers.

Perfect just what I was searching for! .

Today, taking into consideration the fast life style that everyone is having, credit cards get this amazing demand throughout the economy. Persons coming from every area are using the credit card and people who are not using the credit card have made up their minds to apply for even one. Thanks for sharing your ideas on credit cards.

Hey, I simply hopped over to your web page via StumbleUpon. No longer something I would normally learn, but I liked your thoughts none the less. Thank you for making something price reading.

I love reading through an article that will make men and women think. Also, thank you for permitting me to comment.

An fascinating discussion will probably be worth comment. I’m sure you should write more about this topic, it might often be a taboo subject but normally people are too little to dicuss on such topics. To another location. Cheers

Awesome post, will be a daily visitor from now on!

Superb read, I just passed this onto a friend who was doing a little research on that. And he really bought me lunch because I found it for him smile So let me rephrase that: Thanks for lunch!

baby strollers with high traction rollers should be much safer to use compared to those with plastic wheels-

Hi, I do believe this is a great web site. I stumbledupon it 😉 I will revisit once again since I bookmarked it. Money and freedom is the greatest way to change, may you be rich and continue to guide other people.

my sister is an addict on Slot Machines, she always play any kind of game on the slot machine,,

Any way I’ll be subscribing to your feed and I hope you post again soon. I will remember this.

I bookmared your site a couple of days ago coz your blog impresses me..~`:~

Your style is so unique in comparison to other people I’ve read stuff from. Many thanks for posting when you’ve got the opportunity, Guess I’ll just bookmark this blog.

you’ve gotten an ideal weblog right here! would you like to make some invite posts on my weblog?

This is very interesting, You are a very skilled blogger. I have joined your feed and look forward to seeking more of your wonderful post. Also, I have shared your site in my social networks!

Very good post! We are linking to this particularly great content on our website. Keep up the great writing.

Aw, this has been an extremely good post. In concept I have to put in writing like that moreover – taking time and actual effort to manufacture a great article… but so what can I say… I procrastinate alot and no indicates apparently go accomplished.

Thank you for taking the time to discuss this particular, Personally i think highly about this and adore learning more on this topic. If at all possible, as you gain knowledge, would you mind upgrading your blog with increased info? It is extremely helpful for me personally.

An extremely interesting read, I may possibly not agree completely, but you do make some very valid points.

I blog frequently and I really thank you for your information. This great article has really peaked my interest. I am going to book mark your blog and keep checking for new information about once per week. I opted in for your RSS feed as well.

The when Someone said a blog, I really hope who’s doesnt disappoint me around this blog. I am talking about, It was my choice to read, but When i thought youd have something intriguing to express. All I hear is really a few whining about something that you could fix in case you werent too busy trying to find attention.

Very nice work with your entry. Many readers may view it in the same light for sure and wholly agree with your idea.

Most significant masculine messages will need to seat and offer honour around the special couple. Beginer audio systems face-to-face with loud throngs of people should always be mindful of my essential rule among bodybuilders including formal presentations, which is own interests self. best man speeches brother

Your current posts always have alot of really up to date info. Where do you come up with this? Just declaring you are very inspiring. Thanks again

I do accept as true with all the ideas you have presented in your post. They are very convincing and will certainly work. Still, the posts are very quick for starters. Could you please prolong them a bit from subsequent time? Thank you for the post.

wow, these are amazing, can you make some prints and sell them, lots of people would buy them nice job, wow

Good article. I will be experiencing a few of these issues as well..

I could not resist commenting. Well written!

It’s difficult to get knowledgeable individuals on this topic, however you seem like there’s more you’re discussing! Thanks

Understanding something of everything and every little thing of one thing?

Good post however I was wanting to know if you could write a litte more on this subject? I’d be very grateful if you could elaborate a little bit further. Bless you!

Way cool! Some extremely valid points! I appreciate you writing this write-up and the rest of the website is very good.

Nice post. I understand some thing more challenging on diverse blogs everyday. It will always be stimulating to read content from other writers and use a little something from their website. I’d would prefer to apply certain together with the content in my small weblog whether you do not mind. Natually I’ll provide a link on your own web blog. Many thanks for sharing.

Can I just say what relief to locate one who in fact knows what theyre referring to on the web. You certainly learn how to bring a challenge to light and make it important. The diet should check this out and appreciate this side in the story. I cant believe youre not more popular since you absolutely provide the gift.

Considerably, the piece is really the greatest on this worthwhile topic. I agree with your conclusions and will continuously look forward to your future updates. Just saying thanks will not just be enough, for the fantastic lucidity in your writing. I will instantly grab your rss feed to stay informed of any updates. Delightful work and much success in your business endeavors!

Can I just say what a relief to find someone who really knows what theyre talking about on the internet. You definitely know the way to carry a difficulty to mild and make it important. More people must read this and perceive this aspect of the story. I cant imagine youre not more common since you definitely have the gift.

Wonderful site you have here but I was wondering if you knew of any user discussion forums that cover the same topics discussed here? I’d really like to be a part of online community where I can get comments from other knowledgeable people that share the same interest. If you have any suggestions, please let me know. Appreciate it!

This is a topic that’s close to my heart… Take care! Where can I find the contact details for questions?

Way cool! Some very valid points! I appreciate you penning this article and also the rest of the site is very good.

Can I simply say what a aid to find someone who actually knows what theyre speaking about on the internet. You definitely know how one can bring an issue to gentle and make it important. More individuals need to learn this and perceive this aspect of the story. I cant believe youre not more well-liked since you definitely have the gift.

I needed to thank you for this fantastic read!! I certainly enjoyed every little bit of it. I have got you book marked to look at new things you post…

An impressive share! I have just forwarded this onto a friend who was doing a little homework on this. And he in fact bought me lunch because I found it for him… lol. So let me reword this…. Thanks for the meal!! But yeah, thanks for spending the time to discuss this topic here on your website.

Hi, I do think this is a great site. I stumbledupon it 😉 I will revisit yet again since i have book marked it. Money and freedom is the best way to change, may you be rich and continue to help others.

I absolutely love your blog.. Excellent colors & theme. Did you develop this amazing site yourself? Please reply back as I’m planning to create my very own blog and would like to find out where you got this from or just what the theme is named. Many thanks!

I used to be recommended this website by my cousin. I am no longer sure whether this put up is written by way of him as no one else realize such precise approximately my trouble. You are wonderful! Thank you!

In my opinion each of your commercials activated my personal internet browser for you to re-size, you may want to placed that on your own blacklist.

Everything is very open with a very clear clarification of the issues. It was truly informative. Your website is useful. Thank you for sharing.

Very nice post. I just stumbled upon your blog and wanted to say that I’ve truly enjoyed surfing around your blog posts. After all I will be subscribing to your feed and I hope you write again very soon!

Undeniably imagine that that you said. Your favourite justification appeared to be at the internet the simplest thing to consider of. I say to you, I definitely get annoyed even as other people think about issues that they just don’t realize about. You controlled to hit the nail upon the top as smartly defined out the entire thing without having side-effects , other people could take a signal. Will probably be back to get more. Thanks

you can always count on toshiba laptops when it comes to durability, they are really built tough,

You should take part in a contest for one of the highest quality blogs on the internet. I’m going to highly recommend this blog!

It’s difficult to find well-informed people about this subject, but you sound like you know what you’re talking about! Thanks

Having read this I thought it was extremely enlightening. I appreciate you finding the time and effort to put this short article together. I once again find myself personally spending a significant amount of time both reading and commenting. But so what, it was still worthwhile!

This is a topic that’s near to my heart… Thank you! Where can I find the contact details for questions?

This is really interesting, You’re a very skilled blogger. Ive joined your rss and appear forward to seeking really your great post. Also, I have shared your web site during my social networks!

There is noticeably a lot to know about this. I believe you made certain nice points in features also.

herbal supplementation is the best because i love organic supplements and herbal is organic`

Next time I read a blog, I hope that it does not fail me as much as this particular one. I mean, Yes, it was my choice to read through, however I genuinely believed you’d have something interesting to say. All I hear is a bunch of whining about something that you could possibly fix if you were not too busy seeking attention.

You lost me, friend. Get real, I imagine I get what youre saying. I am aware what you’re saying, nevertheless, you just appear to have forgotten that might be other sorts of folks from the world who view this challenge for which it happens to be and might perhaps not go along with you. You might be turning away much individuals who had been lovers of this website.

Way cool! Some very valid points! I appreciate you writing this write-up and also the rest of the site is also very good.

Your blog is amazing dude. i love to visit it everyday. very nice layout and content ,

Perfect work you have done, this site is really cool with excellent information.

I want to to thank you for this great read!! I certainly loved every bit of it. I have you bookmarked to look at new stuff you post…

Spot on with this write-up, I really believe this site needs a lot more attention. I’ll probably be back again to read more, thanks for the info!

Hi! I could have sworn I’ve visited your blog before but after looking at many of the articles I realized it’s new to me. Regardless, I’m definitely happy I stumbled upon it and I’ll be book-marking it and checking back frequently!

I was able to find good information from your blog posts.

I couldn’t refrain from commenting. Well written!

Aw, this was an extremely nice post. Taking a few minutes and actual effort to produce a really good article… but what can I say… I hesitate a whole lot and don’t manage to get nearly anything done.

I was able to find good advice from your content.

Hello there, I think your website might be having internet browser compatibility issues. Whenever I take a look at your web site in Safari, it looks fine however, if opening in Internet Explorer, it has some overlapping issues. I simply wanted to give you a quick heads up! Other than that, fantastic blog.

Great info. Lucky me I recently found your blog by accident (stumbleupon). I’ve bookmarked it for later!

I’m excited to discover this website. I want to to thank you for your time for this fantastic read!! I definitely savored every part of it and i also have you book marked to check out new stuff on your web site.

It’s difficult to find well-informed people in this particular topic, but you sound like you know what you’re talking about! Thanks

Right here is the perfect blog for anyone who really wants to understand this topic. You understand so much its almost hard to argue with you (not that I really will need to…HaHa). You definitely put a brand new spin on a topic that’s been discussed for ages. Wonderful stuff, just great.

Great article. I’m going through a few of these issues as well..

I have to thank you for the efforts you have put in writing this site. I’m hoping to check out the same high-grade content by you later on as well. In truth, your creative writing abilities has motivated me to get my own, personal website now 😉

Aw, this was an exceptionally nice post. Taking a few minutes and actual effort to generate a very good article… but what can I say… I hesitate a whole lot and don’t manage to get nearly anything done.

Hello there! This post couldn’t be written much better! Looking through this post reminds me of my previous roommate! He continually kept preaching about this. I most certainly will forward this post to him. Fairly certain he’ll have a very good read. Thanks for sharing!

Everything is very open with a precise clarification of the challenges. It was truly informative. Your website is useful. Thank you for sharing!

I enjoy looking through an article that will make people think. Also, thank you for permitting me to comment.

There is certainly a lot to know about this issue. I really like all of the points you’ve made.

You ought to be a part of a contest for one of the best sites online. I most certainly will recommend this website!

Your style is so unique compared to other people I’ve read stuff from. Many thanks for posting when you have the opportunity, Guess I will just book mark this blog.

I wanted to thank you for this great read!! I certainly enjoyed every little bit of it. I have got you book-marked to look at new stuff you post…

Hi! I simply would like to offer you a big thumbs up for your great information you have got here on this post. I am coming back to your web site for more soon.

I couldn’t refrain from commenting. Very well written!

Great article. I will be facing some of these issues as well..

Spot on with this write-up, I honestly believe this web site needs much more attention. I’ll probably be back again to see more, thanks for the information.

An impressive share! I’ve just forwarded this onto a friend who had been doing a little homework on this. And he in fact bought me dinner due to the fact that I discovered it for him… lol. So let me reword this…. Thank YOU for the meal!! But yeah, thanks for spending the time to talk about this subject here on your internet site.

I used to be able to find good advice from your articles.

Your style is so unique in comparison to other folks I’ve read stuff from. Thanks for posting when you’ve got the opportunity, Guess I’ll just bookmark this page.

May I just say what a relief to find somebody that actually understands what they’re talking about on the internet. You certainly realize how to bring a problem to light and make it important. More and more people have to look at this and understand this side of the story. I can’t believe you are not more popular given that you most certainly have the gift.

I’m impressed, I have to admit. Rarely do I encounter a blog that’s both equally educative and engaging, and without a doubt, you have hit the nail on the head. The problem is something too few men and women are speaking intelligently about. Now i’m very happy I found this in my hunt for something concerning this.

The very next time I read a blog, I hope that it doesn’t disappoint me as much as this one. After all, Yes, it was my choice to read, however I truly believed you’d have something useful to say. All I hear is a bunch of complaining about something that you could possibly fix if you weren’t too busy looking for attention.

Hello there! I just would like to give you a big thumbs up for your excellent information you’ve got here on this post. I am returning to your blog for more soon.

I want to to thank you for this wonderful read!! I certainly enjoyed every bit of it. I have got you book-marked to look at new things you post…

Spot on with this write-up, I really believe this website needs a great deal more attention. I’ll probably be returning to read more, thanks for the info!

Excellent site you have got here.. It’s difficult to find high-quality writing like yours these days. I honestly appreciate individuals like you! Take care!!

Everything is very open with a very clear description of the challenges. It was really informative. Your website is extremely helpful. Thanks for sharing.

Oh my goodness! Impressive article dude! Thank you so much, However I am experiencing troubles with your RSS. I don’t understand the reason why I am unable to subscribe to it. Is there anyone else having similar RSS issues? Anybody who knows the answer will you kindly respond? Thanks.

Your style is so unique in comparison to other people I have read stuff from. I appreciate you for posting when you have the opportunity, Guess I’ll just bookmark this site.

After I initially commented I seem to have clicked the -Notify me when new comments are added- checkbox and now every time a comment is added I recieve 4 emails with the exact same comment. Perhaps there is a means you can remove me from that service? Thanks.

A motivating discussion is worth comment. There’s no doubt that that you need to write more about this subject, it might not be a taboo subject but typically folks don’t speak about such issues. To the next! Many thanks!

A motivating discussion is worth comment. I believe that you need to publish more about this issue, it may not be a taboo subject but generally people do not talk about these issues. To the next! Many thanks.

Hi, I do believe this is an excellent website. I stumbledupon it 😉 I’m going to return yet again since i have bookmarked it. Money and freedom is the greatest way to change, may you be rich and continue to help other people.

Thanks, I have recently been hunting for info about this subject matter for ages and yours is the best I have located so far.

Great article. I’m experiencing a few of these issues as well..

I was able to find good advice from your blog posts.

I would like to thank you for the efforts you’ve put in writing this website. I’m hoping to see the same high-grade content by you in the future as well. In truth, your creative writing abilities has motivated me to get my own site now 😉

I was able to find good information from your content.

Hi there! This blog post could not be written much better! Reading through this article reminds me of my previous roommate! He constantly kept preaching about this. I most certainly will forward this article to him. Pretty sure he’s going to have a good read. Many thanks for sharing!

I blog frequently and I seriously thank you for your information. This great article has truly peaked my interest. I will book mark your blog and keep checking for new details about once a week. I opted in for your Feed too.

Very good information. Lucky me I recently found your blog by accident (stumbleupon). I have saved it for later!

I needed to thank you for this very good read!! I definitely loved every little bit of it. I have got you book marked to look at new stuff you post…

I love it when individuals come together and share opinions. Great website, continue the good work.

bookmarked!!, I really like your site!

Oh my goodness! Impressive article dude! Thank you so much, However I am going through problems with your RSS. I don’t understand why I am unable to subscribe to it. Is there anybody else getting identical RSS issues? Anyone who knows the answer can you kindly respond? Thanks.

Great post. I’m dealing with some of these issues as well..

Saved as a favorite, I like your blog!

Spot on with this write-up, I truly believe this web site needs much more attention. I’ll probably be returning to see more, thanks for the information!

Good day! I simply wish to give you a big thumbs up for your excellent information you have got here on this post. I am coming back to your blog for more soon.

This web site definitely has all of the information and facts I needed concerning this subject and didn’t know who to ask.

After checking out a few of the blog posts on your site, I honestly appreciate your technique of writing a blog. I bookmarked it to my bookmark website list and will be checking back in the near future. Please visit my web site too and let me know your opinion.

Pretty! This was a really wonderful article. Thanks for supplying this info.

There is certainly a great deal to find out about this subject. I really like all of the points you made.

This site certainly has all the information and facts I needed about this subject and didn’t know who to ask.

I’m excited to find this site. I need to to thank you for your time for this particularly wonderful read!! I definitely loved every part of it and i also have you saved to fav to look at new stuff in your blog.

I am usually to blogging and that i truly appreciate your articles. The article has really peaks my interest. I am going to bookmark your web site and maintain checking for first time information.

Nice post. I learn something new and challenging on blogs I stumbleupon everyday. It will always be exciting to read through content from other writers and use a little something from their sites.

I blog quite often and I truly appreciate your content. This article has really peaked my interest. I will book mark your site and keep checking for new details about once a week. I subscribed to your Feed too.

Hello there! This blog post could not be written any better! Looking at this post reminds me of my previous roommate! He constantly kept preaching about this. I will send this information to him. Pretty sure he’ll have a good read. Thank you for sharing!

Some genuinely nice stuff on this internet site , I it.

Nice post. I find out some thing more challenging on various blogs everyday. It will always be stimulating to study content from other writers and use something from their site. I’d want to use some with the content on my blog whether you do not mind. Natually I’ll provide you with a link on your internet blog. Appreciate your sharing.

You are so cool! I don’t think I’ve truly read anything like this before. So good to discover someone with some genuine thoughts on this subject. Seriously.. many thanks for starting this up. This web site is something that’s needed on the internet, someone with a bit of originality.

When I initially commented I appear to have clicked on the -Notify me when new comments are added- checkbox and from now on every time a comment is added I get four emails with the exact same comment. Is there an easy method you can remove me from that service? Appreciate it.

You actually make it seem so easy with your presentation but I find this topic to be really something that I think I would never understand. It seems too complicated and very broad for me. I’m looking forward for your next post, I’ll try to get the hang of it!

A fascinating discussion is definitely worth comment. I do believe that you should write more about this subject, it might not be a taboo subject but usually folks don’t discuss these issues. To the next! Kind regards.

I used to be able to find good info from your articles.

After study a handful of the blog articles in your website now, we genuinely much like your means of blogging. I bookmarked it to my bookmark site list and are checking back soon. Pls check out my web site at the same time and figure out if you agree.

After study a number of the web sites for your web site now, and that i truly such as your method of blogging. I bookmarked it to my bookmark site list and you will be checking back soon. Pls look into my web site as well and told me how you feel.

Spot on with this write-up, I seriously believe that this website needs far more attention. I’ll probably be back again to read through more, thanks for the info.

There’s definately a lot to learn about this subject. I like all of the points you’ve made.

Spot on with this write-up, I absolutely feel this website needs a lot more attention. I’ll probably be returning to read more, thanks for the info.

Excellent article it is without doubt. My father has been waiting for this info.

Hi, I just found your website via Bing. Your article is truly applicable to my life right now, and I’m really delighted I found your website.

Great weblog here! Also your site lots up fast! What host are you the use of? Can I am getting your affiliate hyperlink for your host? I wish my web site loaded up as fast as yours lol

Very good post! We will be linking to this great post on our website. Keep up the great writing.

I could not resist commenting. Perfectly written.

I really love your site.. Very nice colors & theme. Did you build this amazing site yourself? Please reply back as I’m wanting to create my own personal blog and want to find out where you got this from or exactly what the theme is named. Appreciate it.

Very good information. Lucky me I found your site by chance (stumbleupon). I’ve book marked it for later.

Having read this I thought it was very informative. I appreciate you finding the time and energy to put this content together. I once again find myself personally spending way too much time both reading and leaving comments. But so what, it was still worth it.

An outstanding share! I have just forwarded this onto a friend who was conducting a little homework on this. And he in fact ordered me dinner simply because I stumbled upon it for him… lol. So let me reword this…. Thank YOU for the meal!! But yeah, thanx for spending the time to talk about this matter here on your website.

Way cool! Some very valid points! I appreciate you penning this article and also the rest of the website is also very good.

There is certainly a lot to learn about this issue. I like all the points you’ve made.

Good blog post. I certainly love this website. Thanks!

An interesting discussion is worth comment. I do believe that you should write more on this subject matter, it might not be a taboo subject but typically people do not talk about these issues. To the next! Cheers.

bookmarked!!, I like your web site.

Spot on with this write-up, I absolutely believe this amazing site needs far more attention. I’ll probably be back again to read more, thanks for the info!

You ought to take part in a contest for one of the most useful blogs on the net. I am going to recommend this blog!

An outstanding share! I’ve just forwarded this onto a colleague who was conducting a little homework on this. And he in fact bought me breakfast due to the fact that I found it for him… lol. So allow me to reword this…. Thanks for the meal!! But yeah, thanks for spending some time to discuss this subject here on your web page.

Hello there! I just would like to offer you a huge thumbs up for your excellent info you’ve got here on this post. I’ll be returning to your blog for more soon.

Your style is really unique compared to other people I have read stuff from. I appreciate you for posting when you have the opportunity, Guess I’ll just book mark this blog.

Great post. I am dealing with many of these issues as well..

When I initially commented I appear to have clicked on the -Notify me when new comments are added- checkbox and from now on each time a comment is added I receive four emails with the exact same comment. Is there a means you can remove me from that service? Appreciate it.

Having read this I thought it was extremely enlightening. I appreciate you finding the time and effort to put this short article together. I once again find myself spending a lot of time both reading and posting comments. But so what, it was still worth it!

Hey, I loved your post! Check out my site: ANCHOR.

Oh my goodness! Impressive article dude! Thank you so much, However I am having difficulties with your RSS. I don’t understand the reason why I am unable to subscribe to it. Is there anybody else getting the same RSS issues? Anyone that knows the answer can you kindly respond? Thanks!

This page certainly has all the information I needed about this subject and didn’t know who to ask.

Very good info. Lucky me I discovered your blog by accident (stumbleupon). I’ve saved as a favorite for later.

You made some good points there. I looked on the web for more info about the issue and found most people will go along with your views on this web site.

I would like to thank you for the efforts you’ve put in writing this website. I’m hoping to see the same high-grade blog posts from you in the future as well. In fact, your creative writing abilities has encouraged me to get my very own blog now 😉

Pretty! This has been a really wonderful post. Thanks for providing this info.

Your style is very unique compared to other folks I have read stuff from. Thanks for posting when you have the opportunity, Guess I’ll just book mark this web site.

After exploring a few of the blog posts on your web page, I truly like your technique of blogging. I saved it to my bookmark website list and will be checking back in the near future. Please check out my website too and let me know your opinion.

Very good article. I will be facing a few of these issues as well..

This is a topic that is close to my heart… Cheers! Exactly where can I find the contact details for questions?

After exploring a number of the blog posts on your web page, I seriously appreciate your technique of writing a blog. I book-marked it to my bookmark site list and will be checking back in the near future. Please visit my web site as well and tell me what you think.

Pretty! This was a really wonderful article. Thanks for supplying this info.

Oh my goodness! Amazing article dude! Thanks, However I am experiencing issues with your RSS. I don’t understand why I can’t subscribe to it. Is there anyone else having identical RSS problems? Anyone who knows the answer will you kindly respond? Thanks!

Your style is really unique compared to other people I have read stuff from. Many thanks for posting when you’ve got the opportunity, Guess I’ll just book mark this blog.

You ought to be a part of a contest for one of the finest blogs online. I most certainly will highly recommend this web site!

Way cool! Some very valid points! I appreciate you penning this write-up plus the rest of the website is extremely good.

Loyd CRAWFORD officiating. CONARD, HARRIS Logan County: Guthrie Each day Leader, Wednesday, May 7, 1975 Providers for Louis CONARD, 66, retired Custodian of the primary Nationwide Financial institution, can be held at 11 a.m.

Some pc proficient technicians uncover how to restore lockups, boot-up crashes, resolve issues, drive malfunctions, slowdowns, poor video efficiency, in addition to memory failure.

An impressive share! I’ve just forwarded this onto a friend who has been doing a little homework on this. And he in fact bought me lunch due to the fact that I discovered it for him… lol. So allow me to reword this…. Thank YOU for the meal!! But yeah, thanx for spending time to discuss this matter here on your web site.

He felt that the cars of the future would take into account air drag when they were being designed, using the advantages of aerodynamic styling to ensure a quieter cabin, more stable ride and handling, and improved fuel economy.

8. Market their designs to retailers or directly to the consumers.

Are you able to establish this automobile?

The vast majority of garden is laid to lawn (Image: Savills) A swim spa is included in the sale (Picture: Savills) Drayton is a popular village to the northwest of Norwich, offering several amenities together with two pubs, a financial institution, supermarket, schools, doctors’ surgery and dentist.

On November 18, Alarab Internet, an Arab information site, launched a photograph of three bloodied children and their mother with the caption “martyred massacred household in Gaza”.

Develop authorized and coverage research skills and learn from local specialists, gaining important insight into the inner workings of international locations aside from your individual.

Hi there! This article couldn’t be written any better! Looking at this article reminds me of my previous roommate! He always kept talking about this. I’ll forward this article to him. Fairly certain he’ll have a good read. Thanks for sharing!

According to the National Association of Home Builders, Indianapolis is the most affordable major U.S.

The Securities Fee Malaysia (SC) requires Capital Markets Providers Representatives License (CMSRL) applicants to move varied exams.

This is a topic that’s close to my heart… Take care! Exactly where can I find the contact details for questions?

I blog frequently and I genuinely appreciate your content. This article has really peaked my interest. I will bookmark your blog and keep checking for new details about once per week. I opted in for your Feed as well.

You’re so cool! I do not suppose I’ve read anything like that before. So great to find another person with a few genuine thoughts on this subject. Seriously.. thanks for starting this up. This web site is something that’s needed on the internet, someone with a little originality.

The Kempeitai (Japanese military police) doles out harsh justice: Members of the Kempeitai pose with British POWs.

Financial institutions have used professional software for this purpose, such as Seasonal Analysis Tools.

Use no more than one-half drop within the bath, and avoid its use in cosmetics since it might probably redden and even burn the pores and skin.

Hi! I could have sworn I’ve been to your blog before but after going through a few of the articles I realized it’s new to me. Regardless, I’m certainly delighted I discovered it and I’ll be book-marking it and checking back frequently.

Čech was believed to be sidelined for up to a year, leaving Cudicini as the most senior goalkeeper accessible at Chelsea.

These shows became genuinely well-known, primarily when they have been attended by different Italian designers just like the Fontana sisters and Emilio Pucci.

Use a system of overhead wires and small magnets to suspend necessary, urgent papers where you can see them.

So those are the essential steps involved in trade present shows.

All of the consequences of the picture are created by the colours of the items of glass.

In 1492, Pope Alexander VI (Rodrigo Borja, a Valencian) formally approved the division of the unexplored world between kingdoms of what is today Spain and Portugal.

Calder, Emma (15 Might 2018).

December 13, 1949 to Bruce & Catherine Higbee.

The advantages of long-term mutual fund investments are twofold.

Present your quality. Okay?

10. India has the world’s third largest street network, overlaying greater than 4.3 million kilometers and carrying 60 per cent freight and 87 per cent passenger site visitors.

Variations of DICTOOL are available for each the unique SunView window system and OpenWindows.

Every defeat chips away at his determination to continue as City’s coach.

There are a lot more choices out there than there used to be, so don’t give up the search quite yet.

If financial knowledge is alien to you things will be pretty tough and tricky, you need to know the basic knowledge and credible guidance.

Value of Housework and Parenting Child care, repairs and maintenance are valued equivalent to the amount a household would have to pay for the service.

On November 17, Health Secretary Levine introduced that anyone traveling to Pennsylvania must get a COVID-19 take a look at inside 72 hours of arrival or quarantine for 14 days, effective November 20.

Having read this I believed it was rather enlightening. I appreciate you finding the time and effort to put this information together. I once again find myself spending way too much time both reading and commenting. But so what, it was still worth it!

After I originally commented I appear to have clicked on the -Notify me when new comments are added- checkbox and now every time a comment is added I receive 4 emails with the same comment. There has to be an easy method you are able to remove me from that service? Many thanks.

Lightweight and beautifully crafted, they bring a vintage charm and trendy flair to your jewelry assortment-best for on a regular basis wear or that particular night time out!

Hi, I do believe this is an excellent site. I stumbledupon it 😉 I’m going to return once again since I book-marked it. Money and freedom is the best way to change, may you be rich and continue to guide other people.

When these fund managers decide to include a security in their fund’s portfolio, it is based on sound research and analysis.

Next time I read a blog, I hope that it doesn’t fail me just as much as this one. I mean, Yes, it was my choice to read, however I actually believed you would have something helpful to say. All I hear is a bunch of crying about something that you could possibly fix if you weren’t too busy searching for attention.

The project may be recreated by following the easy information that is included.

Use the on-screen navigation, keyboard, and different menu options to manage the selected Hearth Tv gadget.

In 1957, the Student Conservation Association (SCA) placed its first group of 53 volunteers in Grand Teton and Olympic National Parks to help the park rangers for the summer.

With Composer 7.0, integrators can program an entire end-to-end DSP signal path utilizing just one software.

Sustaining members are senior members who pay dues and participate in certain Junior League features but are no longer required to carry out volunteer work as a prerequisite for continued membership.

Grey, Christopher (September 15, 1996).

Hello there, I think your blog could be having browser compatibility issues. Whenever I take a look at your site in Safari, it looks fine however, if opening in Internet Explorer, it has some overlapping issues. I just wanted to provide you with a quick heads up! Apart from that, great site.

Addressing the co-occurring conditions alongside bipolar disorder requires a collaborative and multidisciplinary approach.

You will see (and may join in on) many arguments about why tipping must be banned, why tipping ought to be necessary, why ideas shouldn’t be “expected,” and why house owners ought to just pay an honest wage.

Spot on with this write-up, I really feel this web site needs far more attention. I’ll probably be returning to read through more, thanks for the information.

In a strategic transfer that move that gives elevated fuel security for its present energy producing belongings and its future energy portfolio expansions, Lanco via its step down Australian Subsidiary , Lanco Resources Australia , has acquired Griffin Coal Mining firm and carpenter Mine Management .

Contractionary monetary coverage is a instrument used by central banks to slow down a rustic’s financial growth.

On March 22, 2020, Philadelphia Mayor Jim Kenney issued a stay-at-house order for the town, set to take impact the next day at 8:00 am.

Ke6, however determined towards it as he “did not wish to play a dark ocean form of position”.

Many write-ups have come out in the press on exactly what makes a coalition federal government successful, and I am struck by the similarities of that with exactly what makes businesses effective.

Excellent blog post. I certainly appreciate this site. Keep writing!

Tax charges were lowered in the 1920s and in 1930 the top revenue tax charge was set to 29.25, and the threshold lowered to £260 of annual earnings.

They are adequately qualified to provide answers to a number of questions that the investor might need answers for.

I’m amazed, I must say. Rarely do I encounter a blog that’s equally educative and amusing, and without a doubt, you have hit the nail on the head. The issue is something which not enough people are speaking intelligently about. Now i’m very happy I found this during my hunt for something regarding this.

sex nhật hiếp dâm trẻ em ấu dâm buôn bán vũ khí ma túy bán súng sextoy chơi đĩ sex bạo lực sex học đường tội phạm tình dục chơi les đĩ đực người mẫu bán dâm

Nice post. I learn something totally new and challenging on websites I stumbleupon every day. It will always be exciting to read articles from other writers and practice a little something from other web sites.

IPOs or Initial Public Affords are means by which a company can increase debt free capital by way of sharing the ownership and income.

Dropping in a conversation system, talent and augmentation programs, our stock and other 2D interface screens, major AI modifications, and so forth could have been far more difficult.

That’s why it is of their best curiosity to agree on a cost plan with you.

Everyone loves it when individuals get together and share opinions. Great website, continue the good work.

Interesting to notice here that earnings generated from Thailand dividends have comparable tax price as peculiar revenue while income generated from long phrases returns is taxed just about lower compare to taxation ordinary earnings.

Hello there! I just want to give you a huge thumbs up for your great info you have got right here on this post. I’ll be coming back to your web site for more soon.

Millennials are a distinctive generation in many ways.

New York Metropolis, Philadelphia in 1777, and Charleston, South Carolina, had been all main cities used to detain American prisoners of struggle.

There are various points you need to cover while going to perform such task.

Can I simply just say what a comfort to find an individual who actually understands what they are talking about on the web. You actually know how to bring a problem to light and make it important. More people should check this out and understand this side of your story. I was surprised that you’re not more popular given that you surely have the gift.

This web site definitely has all the information I wanted concerning this subject and didn’t know who to ask.

Aw, this was an exceptionally nice post. Spending some time and actual effort to make a very good article… but what can I say… I put things off a lot and don’t seem to get anything done.

The British royal family is strictly forbidden from signing autographs due to the risk of the autographs being cast by others to be used for their commercial acquire.

We’re versatile and might customize our companies to create experiences that completely align with their vision.

Knowledge Entry Specialist. Median Pay: $35,833.

Tempo’s only changes of note in this period were loss of the AWD option after 1991 (when it was called “Four Wheel Drive”) and the ’92 addition of the 3.0-liter Taurus V-6 as standard for top-line GLS models (which then went away) and an option elsewhere.

Hence, start investing as quickly as doable to take the benefit of compounding at later stages.

The key is to wait and watch for one of the previously mentioned indexes to have what is called a follow-through day.

Indianapolis Motor Speedway diagram: Obtain a PDF of the Indianapolis Motor Speedway format.

You’ve made some really good points there. I checked on the net for additional information about the issue and found most individuals will go along with your views on this web site.

You ought to take part in a contest for one of the most useful sites on the internet. I’m going to highly recommend this website!

I wanted to thank you for this wonderful read!! I absolutely loved every bit of it. I have got you book-marked to look at new things you post…

Saved as a favorite, I really like your site.

Good information. Lucky me I found your site by accident (stumbleupon). I’ve saved as a favorite for later.

I couldn’t resist commenting. Well written!

This is a topic which is close to my heart… Many thanks! Where can I find the contact details for questions?

This page certainly has all the info I wanted about this subject and didn’t know who to ask.

After going over a number of the articles on your blog, I really appreciate your technique of writing a blog. I saved it to my bookmark website list and will be checking back in the near future. Please check out my web site as well and tell me what you think.

This was a great read! Your insights are truly helpful and make complex topics easy to understand. Looking forward to more!

Next, see a brand new trend within the funding market.

In 2001, a “tax freeze” that prevented the further enhance of taxes was administered by the then liberal-conservative government of Denmark.

One rule of thumb to always comply with is to avoid stroganoffs and casserole dishes that come floating in heavy cream sauces and gravies.

Over the course of a few a long time, networking and computing technology have improved at exponential rates.

It opened in 2021 in Elmont, New York, as the house of the National Hockey League’s New York Islanders at a price $1.5 billion.

It will help drive some of their visitors your approach, and you will get backlink love that’ll enhance your Website positioning.

The final event was held in 1971, and the ski area was converted to a path system for hiking and downhill mountain biking.

You can find the Forex specialist companies whose core business is to provide foreign currency exchange rates trading.

Let’s check out the same!

I’ve by no means forgotten that, and i look spherical and see lots of women working hard when they might work “light” with equally efficient outcomes.

We’re talkin’ accommodation, entry to huge landmarks, meals, island cruises and so way more.

What’s the name for a batter who tries to anticipate a pitch?

Seek for misfit toys with A. Mouse in Discover Christmas Toys — and see if you’ll find some frazzled elves.

Way cool! Some very valid points! I appreciate you writing this post and also the rest of the site is also really good.

Remember that contract? It’s a binding agreement between you and your contractor that spells out exactly the work to be done.

The Wall Street Journal Economic Survey, also known as the Wall Street Journal Economic Forecasting Survey, could refer to either the monthly or the semi-annual survey conducted by the Wall Street Journal of over 50 economists on important indicators of the economy of the United States.

Gamers can earn in-sport diamonds from different game actions to reserve spots on the Diamond Stage as well as to unlock extra cosmetics, songs, and other options.

Entry to all materials: classes prep, recording of lessons, booklets…

Magnetism of securities market is such it attracts any capitalist.

Strategies of managing danger fall into multiple classes.

At first light on the 8th, coastal batteries and warships began to fireplace and French airplanes to strafe.

Fluppy Dog was marketed to young girls in the mid-1980s.

For those who do have an thought of your budget it will help each you and/or your event administration company.

Simpson died Tuesday at Logan County Memorial Hospital.

The shephard nation is blind and dumb, each man is a structure to oneself.

Nice post. I learn something new and challenging on blogs I stumbleupon every day. It’s always useful to read articles from other authors and practice a little something from their web sites.

Hey there! I simply wish to offer you a huge thumbs up for your great info you have got right here on this post. I will be coming back to your web site for more soon.

I absolutely love your blog.. Great colors & theme. Did you make this site yourself? Please reply back as I’m looking to create my very own blog and want to find out where you got this from or exactly what the theme is named. Cheers.

To become a fully licensed driver, you will need to complete a driver education course and pass a driving test.

I would like to say a huge thank you for being so professional

and I’m so pleased I picked your company to help with my business.

There’s definately a lot to find out about this topic. I like all of the points you’ve made.

This fee will be invoiced to you every three years on the anniversary of your authority,

unless you request to cancel before that date.

Good blog you have got here.. It’s difficult to find excellent writing like yours nowadays. I honestly appreciate people like you! Take care!!

I would like to thank you for the efforts you’ve put in writing this site. I’m hoping to see the same high-grade content from you later on as well. In fact, your creative writing abilities has inspired me to get my own website now 😉

This site was… how do you say it? Relevant!! Finally I’ve found something that helped me. Thank you!

When I originally commented I appear to have clicked the -Notify me when new comments are added- checkbox and now whenever a comment is added I recieve 4 emails with the exact same comment. Is there a means you can remove me from that service? Many thanks.

Very useful content! I found your tips practical and easy to apply. Thanks for sharing such valuable knowledge!

Your style is unique in comparison to other people I have read stuff from. Many thanks for posting when you have the opportunity, Guess I will just book mark this page.

Great information. Lucky me I ran across your blog by chance (stumbleupon). I have book-marked it for later.

I couldn’t refrain from commenting. Perfectly written!

Great article! I learned a lot from your detailed explanation. Looking forward to more informative content like this!

Thanks for sharing. Like your post.Name

After I initially commented I appear to have clicked the -Notify me when new comments are added- checkbox and from now on each time a comment is added I receive four emails with the same comment. There has to be an easy method you are able to remove me from that service? Kudos.

Nice post. I learn something new and challenging on sites I stumbleupon everyday. It’s always interesting to read through content from other writers and practice a little something from their websites.

Very useful content! I found your tips practical and easy to apply. Thanks for sharing such valuable knowledge!

Nice post. I learn something totally new and challenging on sites I stumbleupon everyday. It’s always exciting to read content from other writers and practice a little something from other web sites.

This site truly has all of the information I wanted concerning this subject and didn’t know who to ask.

When seeking inspiration for recent country fashion that is a bit more eclectic, consider the Asian aesthetic.

In the rest of this article, we’ll explain the services offered through online banks, highlight the advantages of ditching brick-and-mortar banks, and discuss the hottest topic in online banking: security.

Carat weight: When determining the worth of Turquoise gemstone, Weight all the time plays an vital role.

Based on the Federal Bureau of Investigation, a Securities fraud lawyer would enable you in telling about solid information on a company’s fiscal statement, and Securities and Exchange Commission (SEC) filings; being hypocritical to business auditors; insider buying and selling; inventory management schemes, and misuse by stockbrokers.

Total size grew by three inches.

An out-of-pocket expense maximum, or cap, is the amount that you’ve to fulfill to ensure that the insurance company to pay one hundred percent of your policy’s benefits.

Aw, this was a very nice post. Taking a few minutes and actual effort to produce a very good article… but what can I say… I procrastinate a whole lot and never manage to get nearly anything done.

sex nhật hiếp dâm trẻ em ấu dâm buôn bán vũ khí ma túy bán súng sextoy chơi đĩ sex bạo lực sex học đường tội phạm tình dục chơi les đĩ đực người mẫu bán dâm

I want to to thank you for this wonderful read!! I definitely enjoyed every bit of it. I’ve got you book marked to check out new stuff you post…

Loved this!

bookmarked!!, I like your website.

Aw, this was a very nice post. Spending some time and actual effort to generate a superb article… but what can I say… I procrastinate a whole lot and don’t manage to get anything done.

Your style is so unique in comparison to other folks I’ve read stuff from. Many thanks for posting when you’ve got the opportunity, Guess I will just book mark this blog.

This post is very helpful! I appreciate the effort you put into making it clear and easy to understand. Thanks for sharing!

I appreciate the depth of research in this article. It’s both informative and engaging. Keep up the great work!

Hello! I just wish to give you a big thumbs up for the great info you have here on this post. I’ll be coming back to your blog for more soon.

Your style is very unique in comparison to other folks I’ve read stuff from. Thank you for posting when you’ve got the opportunity, Guess I will just bookmark this site.

That is a really good tip especially to those fresh to the blogosphere. Short but very accurate info… Thank you for sharing this one. A must read article.

After exploring a few of the blog articles on your web page, I really like your technique of writing a blog. I bookmarked it to my bookmark webpage list and will be checking back in the near future. Please check out my web site too and let me know your opinion.

This site was… how do I say it? Relevant!! Finally I have found something that helped me. Many thanks.

sex nhật hiếp dâm trẻ em ấu dâm buôn bán vũ khí ma túy bán súng sextoy chơi đĩ sex bạo lực sex học đường tội phạm tình dục chơi les đĩ đực người mẫu bán dâm

Federal loans additionally come with choices for deferment and forbearance – a short lived break from funds – in the event you fall into monetary issue.

He had beforehand proven the van pictured on the cover in various posts.

Due to their proximity to Communist Cuba and the United States, as properly as the presence of both Marxist and anti-Communist army teams, Central and South America performed important roles within the Chilly Warfare.

Couscous is a grain often cooked with spices, veggies, nuts and raisins; meat may also be added.

After a day on the seashore with nothing more than one software of SPF 15, you might be cursing our planet for tipping you so shut.

Thus, light and darkish are the twin manifestations of that which known as directly absolute mild and darkness; spirit and matter are the dual manifestations of the one life; essentially the most fundamental duality being the alternation between manvantara and pralaya, that are elements of the ever-productive ineffable supply.

Decide the cartoon where this future comes to life?

The player’s character ultimately defeated Sion, and was then given the choice to show him again to the sunshine facet.

Crypton Fabric Web site.

Everything is very open with a very clear description of the challenges. It was truly informative. Your site is very useful. Thanks for sharing!

You made some really good points there. I looked on the web for more info about the issue and found most people will go along with your views on this web site.

The skin abrasions caused by biting and chewing the fingers and nails create excellent entry points for the HPV virus.

Once you create your account, Stickam will present several choices to you.

It’s best to take duty for repaying that pupil loan, finances accordingly, build a stable credit score historical past and help make it possible for the Stafford mortgage program to continue to again low-interest loans for college kids.

Very interesting topic , thankyou for posting .

Actively managed ETFs include active management, whereby the manager executes a specific trading strategy instead of replicating the performance of a stock market index.

The typical home wants 126,360,000 joules per day (1 kilowatt-hour (kWh) is 3,600,000 joules and the typical American dwelling needs 35 .1 kWhs per day) An average photo voltaic flare produces 1,000,000,000,000,000,000,000 joules, or “one sextillion” joules.

You may still be working in a lab, you should still have a tutorial supervisor, and you could even still park in the identical parking lot.

Overview your credit report and proper any errors you find.

Way cool! Some extremely valid points! I appreciate you writing this article plus the rest of the website is also very good.

After study several of the web sites on your site now, i genuinely much like your strategy for blogging. I bookmarked it to my bookmark site list and you will be checking back soon. Pls consider my internet site too and figure out what you consider.

Great article. I will be going through a few of these issues as well..

The Nazis suspected Vichy involvement after Operation Torch.

As such, the Umrah and Hajj are incredibly spiritual and vital events, Muslims ought to carry out these pilgrimages multiple instances, because it may very well be attainable for them.

Theta: Theta stands for time; it measures the change in the value of an option with reference to the change in the expiry time of the option contract.

A three-digit number — your credit score — can determine whether you can do these things and even how much it will cost you.

Having read this I believed it was very informative. I appreciate you spending some time and energy to put this content together. I once again find myself personally spending a lot of time both reading and commenting. But so what, it was still worthwhile.

Very good information. Lucky me I ran across your website by chance (stumbleupon). I have book marked it for later.

This is a topic that’s near to my heart… Best wishes! Where are your contact details though?

Pamela Jeanne Griffin-Smith. For political service.

They’ve discovered that each arch strikes simply somewhat in a different way, resonating in response to the atmosphere around them.

Great blog you’ve got here.. It’s difficult to find quality writing like yours nowadays. I honestly appreciate people like you! Take care!!

Oh my goodness! Impressive article dude! Thank you so much, However I am having troubles with your RSS. I don’t know why I cannot join it. Is there anybody having the same RSS problems? Anyone who knows the solution will you kindly respond? Thanx!!

Pretty! This was an incredibly wonderful article. Many thanks for providing these details.

Hi there! I could have sworn I’ve been to this web site before but after browsing through some of the posts I realized it’s new to me. Anyways, I’m definitely pleased I came across it and I’ll be book-marking it and checking back frequently!

They rowed every single day.

Jimmy Alexander and Rev.

Very good article! We are linking to this particularly great post on our website. Keep up the good writing.

After looking over a few of the blog articles on your web page, I really like your technique of blogging. I book-marked it to my bookmark website list and will be checking back in the near future. Please check out my web site as well and tell me what you think.

Nice post. I learn something totally new and challenging on blogs I stumbleupon on a daily basis. It will always be exciting to read through articles from other authors and practice a little something from their sites.

Good post! We will be linking to this particularly great article on our website. Keep up the great writing.

The Chile import, export and trade data throughout the portals permit comparability and contrast to take probably the most favorable strategic enterprise choices.

These solutions can cater to any enterprise that seeks to grow and evolve in different market conditions in the global economy.

Paul, Minnesota. Perhaps. In December 2009, the director of the Russian Federal House Company, Anatoly Perminov, announced that Russia was considering making plans to deflect the 270-meter (885-foot) asteroid Apophis from its doable collision course with Earth.

The FBI claimed Gentile was running a pump and dump scheme, where Gentile allegedly hyped a Mexican gold mine and Kentucky gas drilling company in 2007-2008.

That is a really good tip particularly to those fresh to the blogosphere. Brief but very accurate information… Many thanks for sharing this one. A must read article!

I need to to thank you for this fantastic read!! I absolutely enjoyed every bit of it. I have got you saved as a favorite to look at new things you post…

Hi, I do believe this is a great web site. I stumbledupon it 😉 I will come back yet again since i have book marked it. Money and freedom is the greatest way to change, may you be rich and continue to guide other people.

This is a topic which is near to my heart… Thank you! Where can I find the contact details for questions?

Arrangements by Stout-Phillips Funeral Home.

It’s hard to come by educated people for this topic, however, you sound like you know what you’re talking about! Thanks

No surprise it’s acclaimed as a heaven for hikers, photographers and painters.

Good web site you have here.. It’s difficult to find excellent writing like yours these days. I truly appreciate individuals like you! Take care!!

Take a peek at this Fairly Home windows Dishtowel!

Oh my goodness! Impressive article dude! Thank you so much, However I am experiencing difficulties with your RSS. I don’t know the reason why I cannot subscribe to it. Is there anybody getting identical RSS problems? Anyone who knows the answer will you kindly respond? Thanks!!

Hi, I do think this is an excellent website. I stumbledupon it 😉 I will return once again since I bookmarked it. Money and freedom is the best way to change, may you be rich and continue to help others.

Oh my goodness! Incredible article dude! Many thanks, However I am encountering problems with your RSS. I don’t understand the reason why I am unable to subscribe to it. Is there anybody else getting the same RSS issues? Anyone that knows the solution will you kindly respond? Thanx!!

I image this could be various upon the written content material? however I nonetheless believe that it usually is suitable for nearly any type of matter material, because it will frequently be enjoyable to resolve a heat and delightful face or perhaps listen a voice while preliminary landing.